Small Business Employee Benefits

As a small business health insurance broker we help companies with 2 or more full-time employees get the benefits they need.

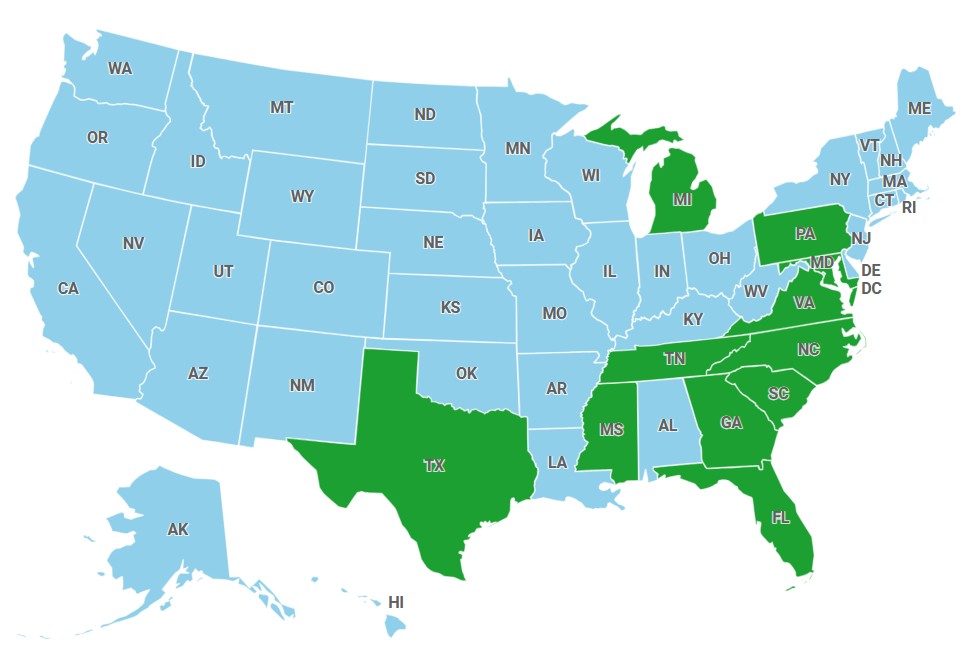

We’re licensed and offer group benefits in Maryland, Pennsylvania & Virginia and the following states through our network of carriers:

If you’re not already working with a small business health insurance broker, and you have less than 50 employees, let’s chat to get started with group benefits:

- Health Insurance

- Dental & Vision

- Life Insurance

- Disability Insurance

- Supplemental Insurance

- Legal & Identity Theft Plans

Our team does the heavy lifting so you can get back to business.

- Employee Education

- Benefits Consultation

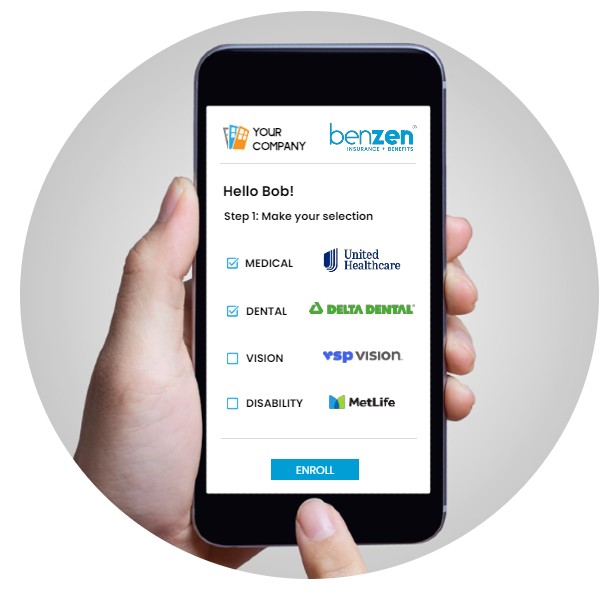

- Digital Enrollment & Renewals

- Benefits Administration

- HR, Compliance & Legal Support

- Tax Advantaged Plans (FSA, HSA, HRA)

Anthem plans are available to our Virginia small groups. For illustration only.

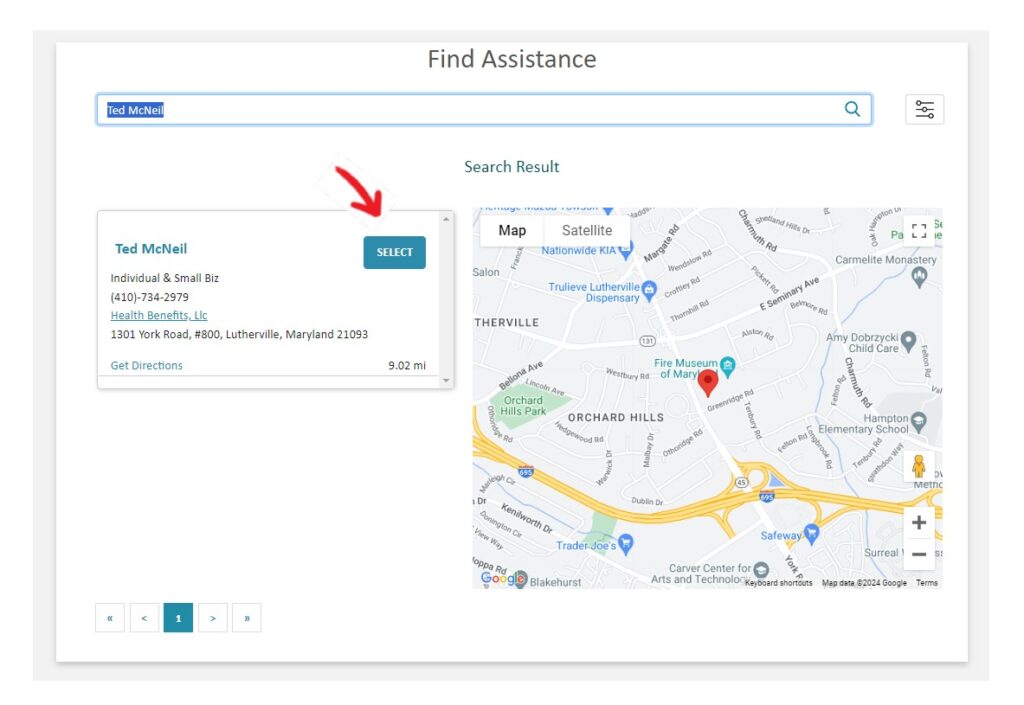

Ted McNeil

Owner, Broker

Schedule A Call

BenZen Insurance

NPN #16365557

Read: “Advantages & Disadvantages of Offering Level-Funded Group Health”

Small Business Health Plans

When you’re running a small business, the health and happiness of your employees can have a major impact on how well your business does.

Having health insurance from top-rated providers doesn’t just protect your business, it also helps make sure you have a strong, healthy, and productive team.

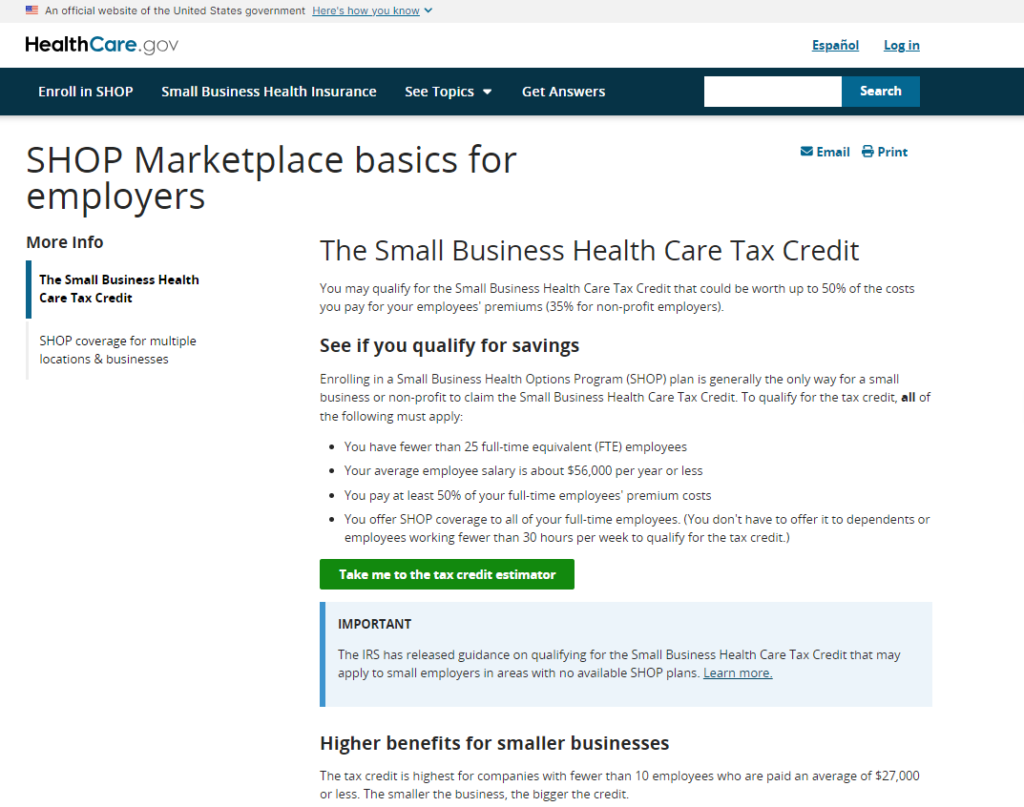

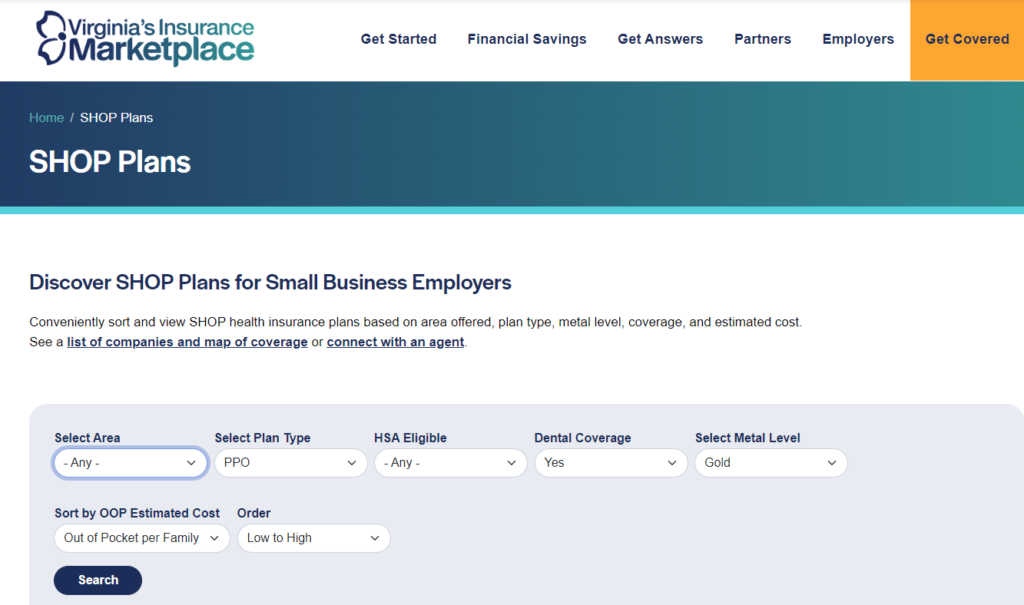

SHOP Health Insurance

The Affordable Care Act introduced a new way for small business employers to find group health insurance.

Employers with less than 50 employees may be able to enroll in Small Business Health Options Program (SHOP) in certain states.

SHOP offers small businesses high-quality marketplace health and dental coverage with flexible enrollment and guaranteed issue, regardless of pre-existing conditions.

You don’t have to go through SHOP for group health insurance unless you want to claim the Small Business Health Care Tax Credit.

Keep in mind, not all states or insurance carriers participate in SHOP marketplace plans.

For example, Maryland, Virginia & Florida offer group marketplace plans, but Pennsylvania does not.

You still have the option of working directly with a broker or insurance company to enroll in group health plans outside of the marketplace (off-exchange), but without the tax credit.

If you meet certain criteria, this tax credit makes you eligible for additional savings for two years.

- Enroll through the Federal Marketplace or your state exchange

- Have fewer than 25 full time-equivalent (FTE) employees

- Pay an average annual salary of less than $58,000 (adjusted for inflation)

- Contribute at least 50% toward employee-only health insurance premiums

If you own a small business and looking to get started with SHOP health insurance contact us or visit the links below.

We are licensed with top-rated carriers and help companies with 2-50 employees in Maryland, Pennsylvania & Virginia.

POPULAR POSTS

- Group Health Insurance For A Small Business With Less Than 10 Employees

- How Much Does It Cost To Set Up A 401k Plan for Small Business?

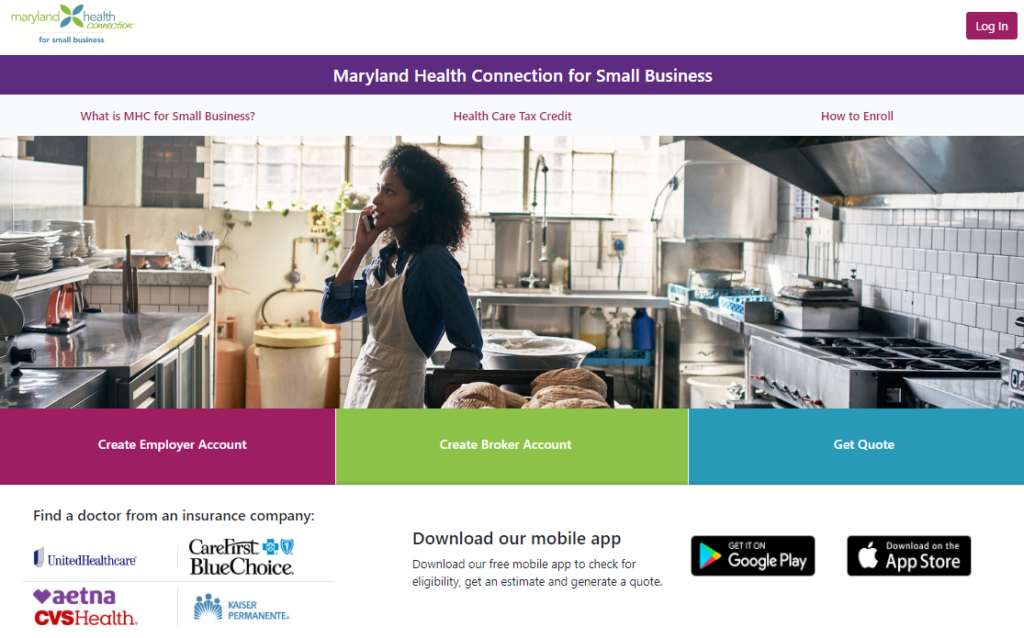

Maryland Small Business Health Insurance

Visit Maryland Health Connection for Small Business to get started with a participating carrier offering SHOP health plans.

- Aetna

- CareFirst

- Kaiser Permamente

- UnitedHealthcare

Maryland Health Connection for Small Business >>

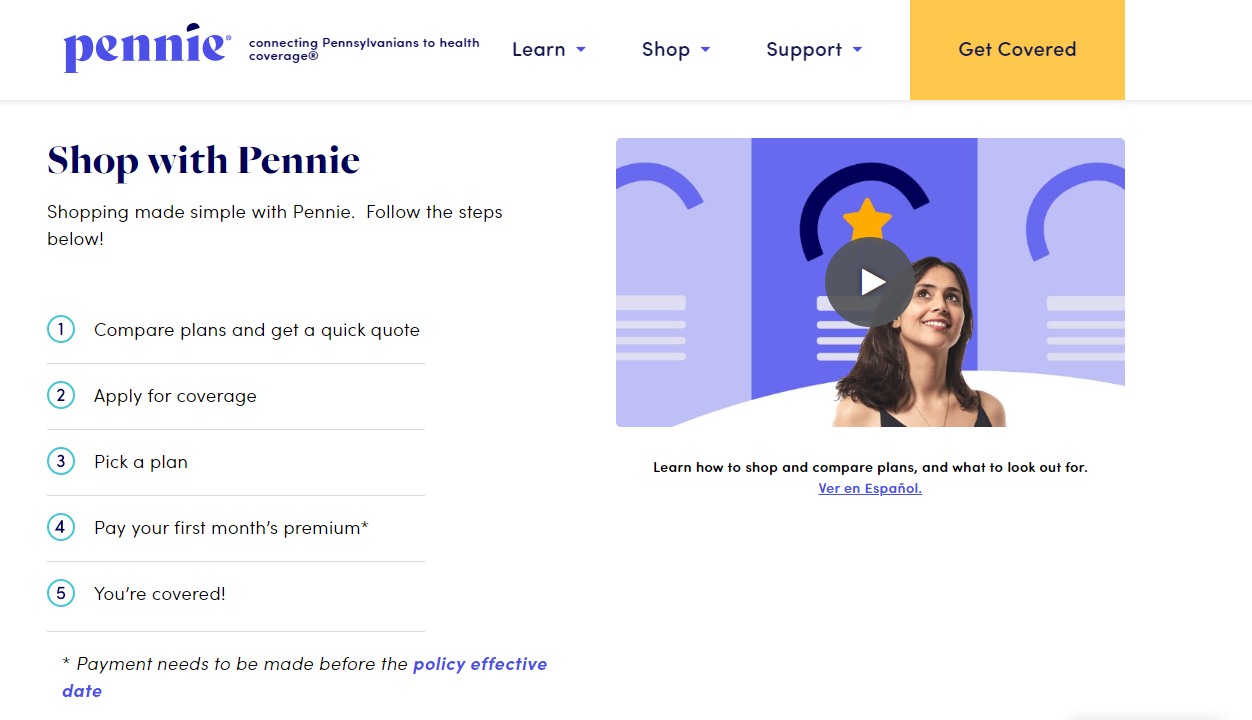

Pennsylvania Small Business Health Insurance

Pennie is the official health insurance marketplace for residents of Pennsylvania shopping for individual coverage. Some employers will refer their workers here to find affordable coverage on their own.

However, for group plans, Pennie does not participate in the SHOP program, (at this time) but you can work directly with a Pennsylvania health insurance broker to get started.

If you’re a small business owner with 2-49 employees in the Greater Philadelphia area contact us to get rates from:

- Highmark

- Independence Blue Cross Blue Shield

- UnitedHealthcare

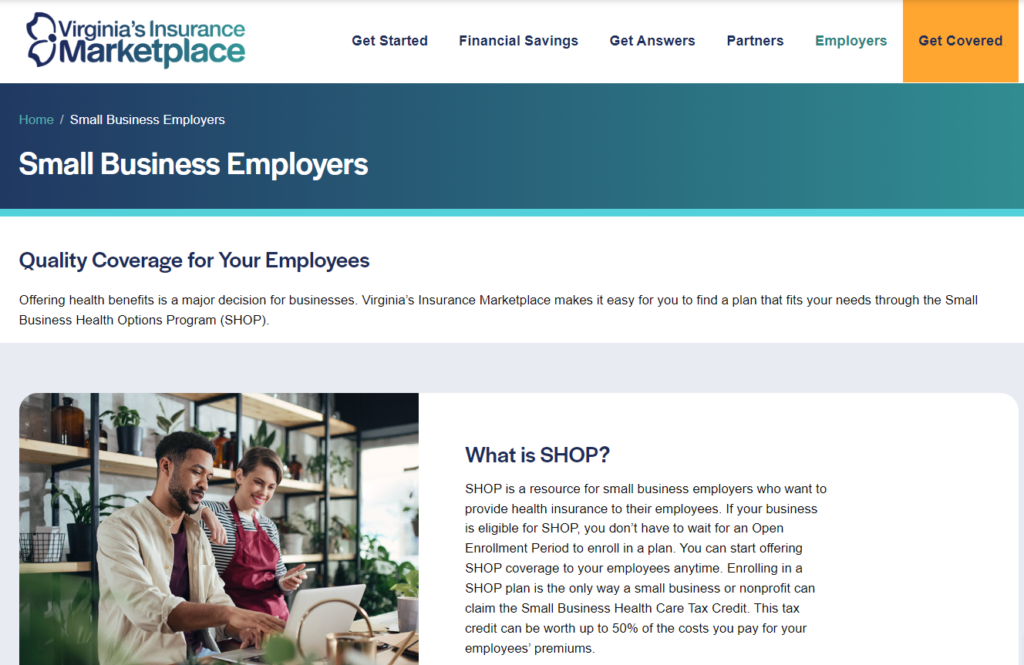

Virginia Small Business Health Insurance

In Virginia, you have two options for SHOP coverage: CareFirst & Kaiser Permamente. You can access these plans directly from Virginia’s Insurance Marketplace. Availability may be limited based on your location.

Request a quote or book a call to get started.

For options outside the marketplace (off-exchange) there are additional plans to choose from for your small business, but you will not be eligible for the Small Business Health Care Tax Credit

- Aetna

- Anthem

- UnitedHealthcare

Virginia’s Insurance Marketplace for Small Business >>

Dental

Dental insurance can help make your employees happier and healthier.

Because this affordable benefit can have a surprisingly strong return on investment, it’s also a huge advantage for small businesses.

By offering voluntary benefits your employees want and need you’ll stand out from the competition, and create a happy, healthy work environment.

Vision

Welcome to VSP Vision where you get a vision plan designed for health, and tailored to meet the coverage, network, and budget needs of your diverse workforce.

Your employees deserve the top choice in vision care.

We’ll partner with you to design a plan for your unique employees, at a price that fits your budget.

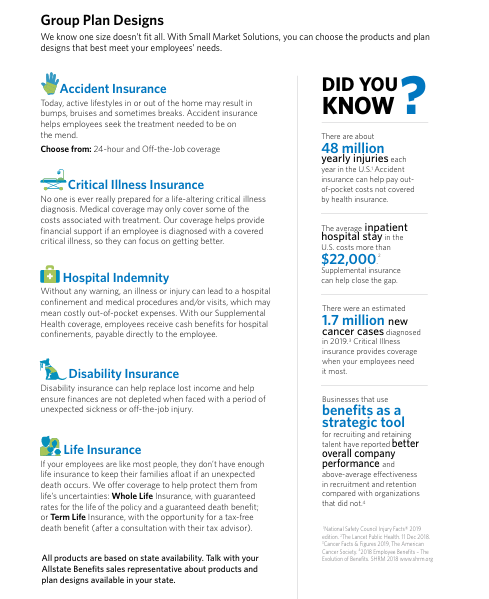

Supplemental Insurance

Supplemental insurance is a simple and cost-effective voluntary benefit you can add to your existing package with little to no direct costs to your company.

You customize the offering and can choose to make contributions. Your employees get to sign up for what they want at discounted group rates through a simple payroll deduction.

- Accident Insurance

- Cancer Insurance

- Hospital Insurance

- Critical Illness Insurance

- Short-Term Disability Insurance

- Group Life Insurance (Term & Whole)

Supplemental plans cover the gaps left with health insurance and help recover out-of-pocket expenses like deductibles, copays, and coinsurance.

With a streamlined online process, supplemental insurance can be integrated into your current benefits any time of year.

How Does Supplemental Insurance Work?

While traditional health insurance covers medical expenses with payments to healthcare providers, supplemental insurance provides lump sum benefits directly to your employees.

Benefits from supplemental plans can be used for anything like deductibles & medical expenses or household bills such as rent, mortgage & child care.

Thanks to you, employees get access to plans and rates only available to small groups.

Minimum group size for supplemental & voluntary is 3 employees.

Legal Plans

LegalShield, a trusted provider of individual and small business legal plans for nearly five decades, extends its services to companies by offering group legal benefits for employees.

Through its network of dedicated attorneys, LegalShield gives your employees access to personal and professional advice, document review, and assistance with diverse legal matters at a discount.

Their small group plans empower employees to seek legal guidance on personal issues spanning estate planning, family law, consumer protection, real estate, and more.

This benefit ensures that employees have access to professional legal advice and representation without incurring high attorney fees.

Identity Theft Protection

IDShield offers services such as credit monitoring, social media monitoring, identity restoration assistance, and access to a team of experts who specialize in identity theft protection.

In the event of identity theft, employees can rely on IDShield to help them restore their identities and mitigate the impact of the theft.

Both LegalShield + IDShield provide employees with peace of mind by offering affordable access to legal services and identity theft protection.

These can be valuable employee benefits as they empower individuals to address legal issues proactively and protect their identities in an increasingly digital world.

Get more information including pricing and how to start offering this phenomenal employee benefit.

Ted McNeil

Owner, Broker

Schedule A Call

BenZen Insurance

NPN #16365557