Selecting group health insurance for a small business is a big decision. Comparing plans, costs and benefits takes valuable time and effort.

As a broker, we put together this guide is to help if you’re considering group health insurance for a small business with less than 10 employees. That’s our specialty!

We’ll explore eligibility, tax credits, plan options and how to get started.

- Health Insurance

- Dental & Vision

- Disability & Life Insurance

- Supplemental (Accident, Critical Illness, Long-Term Care)

If you have questions or would like to get more information contact us!

We help small businesses in all 50 states. Contact us to get started!

Are Small Businesses Required to Offer Group Health Insurance ?

If your business has less than 50 full-time employees you are classified by the Affordable Care Act (ACA) as a small business and not required to provide health insurance to your employees.

However, offering health benefits can be a significant factor in attracting and retaining top talent, and it may also contribute to a healthier, more productive workforce.

Additionally, certain provisions of the Affordable Care Act (ACA) may apply depending on the size of your business, affecting whether you’re subject to penalties for not offering coverage.

Read: “Advantages & Disadvantages of Offering Level-Funded Group Health”

How Many Employees Do I Need for Small Business Group Health Insurance?

With most insurance carriers, you’ll need a minimum of two full-time W-2 employees to be eligible for group rates.

As the owner, one of the employees can be you, but the other must be someone other than a family member.

The requirements and options may vary depending on your location and insurer so be sure to consult with your broker.

Group Health Options for Small Business with 2-10 Employees

According to Healthcare.gov there are several options to providing group health coverage for your small business.

Let’s explore the three main options: traditional group health plans, the SHOP Exchange, and Health Reimbursement Arrangements (HRAs).

- Traditional Group Health Insurance: This is the most familiar option, where you contract directly with an insurer to offer a standardized plan to your employees. It’s a good fit for companies with healthy employee demographics and predictable healthcare costs.

Pros: Simple to set up, offers comprehensive coverage.

Cons: Can be expensive for small businesses, limited plan options.

- The SHOP Exchange (Small Business Health Options Program): This government-run marketplace allows you to compare plans from various insurers and potentially qualify for tax credits that significantly reduce your costs. It can be a good option for businesses seeking more affordable plans with tax breaks.

Pros: Wider range of plans, potential tax credits.

Cons: More complex enrollment process, may have narrower provider networks.

- Health Reimbursement Arrangements (HRAs): HRAs are employer-funded accounts used to reimburse employees for qualified medical expenses. They offer more flexibility but require employees to manage their healthcare spending. This option can be suitable for businesses with a strong sense of employee financial responsibility. (See ICHRA vs QSEHRA)

Pros: Cost-effective for employers, flexible for employees.

Cons: Requires more employee involvement, may not offer comprehensive coverage.

By understanding these options, you can choose the health insurance plan that best meets the needs of your small business and your employees.

Group Health Insurance Terms You Should Know

HMO (Health Maintenance Organization)

An HMO is designed to keep costs low and predictable by only using doctors and hospitals within the HMO network. It typically has low premiums, deductibles, and fixed copays for doctor visits. Primary care physicians (PCPs) are the primary point of contact for all medical care, including specialty referrals.

PPO (Preferred Provider Organization)

PPO networks let the member choose where to go for care, without a referral from a PCP or having to only use providers in your plan’s provider network. These plans typically have higher monthly premiums and out-of-pocket costs like copays, coinsurance, and deductibles.

EPO (Exclusive Provider Organization)

An EPO offers a local network of doctors and hospitals to choose from. If you’re looking for lower monthly premiums and are willing to pay a higher deductible when you need healthcare, you may want to consider an EPO plan.

POS (Point of Service)

A POS plan requires that you get a referral from your PCP before seeing a specialist. This plan covers out-of-network doctors at a higher out-of-pocket cost than in-network doctors.

HDHP (High Deductible Health Plan)

An HDHP has low premiums but higher immediate out-of-pocket costs. Employers often pair HDHPs with a Health Savings Account (HSA). This is a tax-free fund used to offset costs such as deductibles.

Fully-Insured vs Level-Funded?

Similar to the difference between renting and owning a home, each option offers distinct advantages and responsibilities.

Most of us are familiar with fully-insured health plans. This is similar to renting a home. The insurance company, acting as the landlord, sets the premiums and assumes all financial risks related to claims payments.

Employers pay a fixed monthly premium, providing stability but with limited control over costs.

In contrast, level-funded plans are comparable to owning a home. Employers have more flexibility, but added responsibility.

Setting a budget and sharing financial risks. While potential cost savings exist, diligent financial management is necessary to navigate unexpected claims and ensure fiscal health.

Off-Exchange vs On-Exchange: What’s the Difference?

When exploring health insurance options, you may come across the terms “off-exchange” and “on-exchange.”

These terms refer to where you purchase your health insurance plan and what resources you utilize during the process.

Understanding the difference between off-exchange and on-exchange options can help you make informed decisions about your coverage.

On-Exchange Health Insurance

On-exchange health insurance refers to purchasing a health insurance plan through the government-run Health Insurance Marketplace, also known as the exchange.

These marketplaces were established under the Affordable Care Act (ACA) to provide individuals and small businesses with access to subsidized health insurance plans.

When you shop for insurance on the exchange, you may qualify for premium tax credits and other cost-saving subsidies based on your income and household size.

Off-Exchange Health Insurance

You can obtain health insurance directly from an insurance carrier outside of the federal or state marketplace. These are known as off-exchange plans.

Off-exchange plans offer the same essential benefits as on-exchange plans, but they do not qualify for premium tax credits or subsidies.

A business owner might choose off-exchange plans for several reasons, such as flexibility in plan design, competitive pricing & convenience.

What is the Small Business Health Options Program (SHOP)?

The Small Business Health Options Program (SHOP) is a part of the Health Insurance Marketplace created by the ACA.

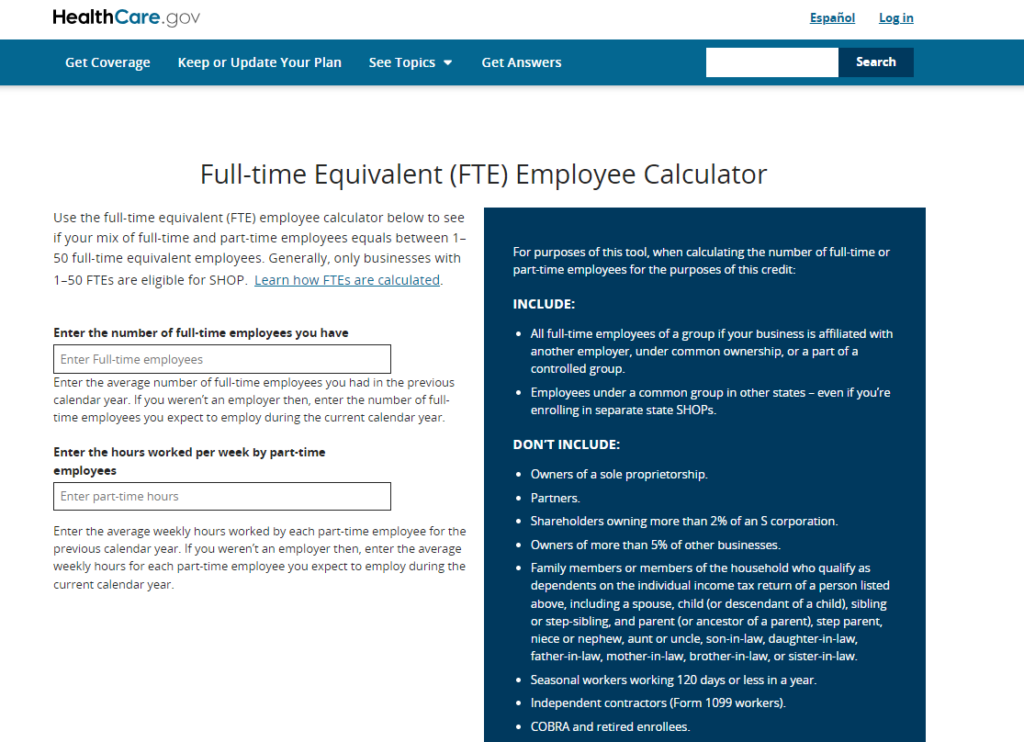

It allows small businesses with 50 or fewer full-time equivalent employees to shop for and purchase health insurance plans for their employees.

SHOP offers a range of coverage options and may provide access to tax credits to help offset the cost of premiums for eligible businesses.

READ MORE:

What is the Small Business Health Care Tax Credit?

The Small Business Health Care Tax Credit is a provision of the ACA designed to help small businesses afford the cost of providing health insurance to their employees.

To qualify for the tax credit, your business must have fewer than 25 full-time equivalent employees, pay average annual wages below a certain threshold, and contribute at least 50% of the premium cost for employee coverage.

The tax credit can be worth up to 50% of the premiums paid by the employer.

How Much Does Group Health Insurance for Small Business Cost?

Understanding the financial aspects of group health insurance for small businesses is crucial for effective planning and budgeting.

The cost of such insurance can fluctuate significantly depending on several key factors. Let’s delve into these considerations and examine average costs across different states, both on-exchange and off-exchange.

Factors Affecting Small Business Health Insurance Costs

The cost of group health insurance for small businesses is influenced by various factors, including:

Location: Insurance premiums can vary based on the state and even within regions of the same state due to differences in healthcare costs, regulations, and market competition.

Business Size: The number of employees covered under the plan can impact premiums, with larger groups often receiving more favorable rates per individual.

Employee Characteristics: Factors such as the age, health status, and industry of your employees can affect insurance costs. Generally, older employees or those in higher-risk industries may lead to higher premiums.

Coverage Level: The extent of coverage offered by the insurance plan, including deductibles, copayments, and covered services, can influence costs.

Average Cost for Small Business Health Insurance Across 4 States

Let’s explore the average costs of group health insurance for small businesses in several states we service:

- Maryland – Small businesses in Maryland can access group health insurance plans through the Maryland Health Connection. On average, premiums range from $400 to $800 per employee per month, depending on coverage levels and employee demographics.

- Pennsylvania – Pennsylvania’s health insurance marketplace, Pennie doesn’t offer SHOP plans for small businesses. However, businesses can explore individual plans or consider other options. Average premiums typically range from $350 to $700 per employee per month.

- Virginia – Virginia’s Insurance Marketplace provides access to plans for small businesses. Premiums vary based on factors such as coverage levels and employee demographics, with average costs ranging from $300 to $600 per employee per month.

- Florida – Small businesses in Florida can explore plans through Healthcare.gov. Average premiums typically range from $350 to $700 per employee per month, depending on coverage levels and employee demographics.

It’s important to note that these are rough estimates, and actual costs can vary based on numerous factors unique to your business and the insurance market in your area.

What’s the Best Group Health Insurance for Small Business With 2-10 Employees?

Determining the best health insurance for your small business depends on various factors, including your budget, the needs of your employees, and the available options in your area.

Here’s a brief overview of popular insurance providers in four states:

- Maryland: CareFirst BlueCross BlueShield, Kaiser Permanente, UnitedHealthcare

- Pennsylvania: Highmark Blue Cross Blue Shield, Independence Blue Cross, UPMC Health Plan

- Virginia: Anthem Blue Cross Blue Shield, Optima Health, Cigna

- Florida: Florida Blue, UnitedHealthcare, Humana

Each of these providers offers a range of plans with different coverage levels and pricing options.

It’s essential to compare quotes and consider factors like network size, coverage features, and customer service when choosing the right insurance for your business.

How to Get Free Assistance from a Small Business Health Insurance Broker

Navigating the complex world of health insurance can be daunting, especially for small business owners with limited time and resources.

Fortunately, you don’t have to go it alone. A small business health insurance broker specializes in helping local companies find the right coverage for their needs.

These professionals can assess your requirements, help you shop for the best plan, educate your employees 1-on-1, and guide you through the enrollment process.

Most health insurance brokers are paid by the insurance carrier so working with the right one won’t cost you a dime!

In conclusion, while offering health insurance as a small business owner is not mandatory, it can have significant benefits for both your employees and your business.

By understanding your options, leveraging available resources like SHOP and the Small Business Health Care Tax Credit, and seeking assistance from a qualified insurance broker, you can find the right coverage to meet your needs and budget.

Investing in the health and well-being of your employees is not only a smart business decision but also a testament to your commitment to their success and happiness.