When it comes to securing a stable financial future for your company and its employees, starting a 401k plan for small business can be a wise decision.

In this guide, we’ll show you how it’s possible to start a 401k for your small business with as little as one employee. If you thought a retirement plan was only for large companies, this guide is for you.

Plus, we’ll introduce you to small business 401k plans ideal for small businesses and show you how to save money on your set up costs.

What is a 401k?

Section 401(k) of the IRS Code allows for “certain cash or deferred arrangements” under qualified pension, profit sharing or stock bonus plans.

It’s a retirement savings plan funded primarily by employees with pretax earnings. Employers have the option to contribute to their employees’ plans, thereby maximizing the full savings potential. There are a few options:

Traditional 401k

Business owners who offer a traditional 401k have the flexibility to contribute the same amount to all participating employees, match individual contribution rates, do both or not contribute at all.

These contributions aren’t vested until a certain amount of time has elapsed. Two of the vesting schedules permitted by the Internal Revenue Code (IRC) are:

- 100% vested after three years of service

- 20% vested after two years of service, followed by an additional 20% each year until employer contributions are 100% vested in year six

Traditional 401k plans are also subject to annual testing to ensure that they don’t disproportionally favor certain participants over others, i.e., highly paid executives vs. average employees.

Safe Harbor 401k

Employers can avoid annual nondiscrimination testing by designing their 401k as a Safe Harbor plan.

The trade-off is that they’re required to contribute to their employees’ plans, either via matching or non-elective contributions. Contributions are also fully vested at the time they are made.

Automatic 401k

An automatic 401k is an ideal option for employers who want to increase plan participation. As the name implies, employees are automatically enrolled at a default contribution rate unless they specifically opt out or change the rate.

401k Plan for Small Business Requirement

You already know employee benefits keep and attract top talent, regardless of the size of your business. They boost job satisfaction and give your company a competitive advantage.

They can provide affordable access to essential health benefits, legal protection, and a path to financial security.

For small businesses, offering benefits such as a 401k is a vital step in ensuring the well-being of their workforce.

In some states, it’s a requirement.

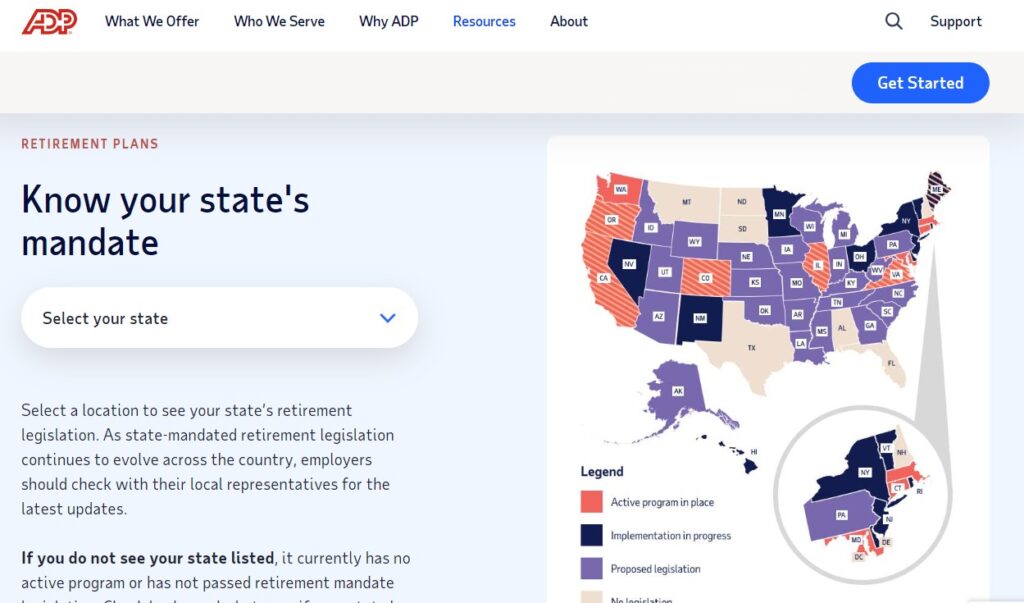

Concerning financial security, many states have enacted legislation mandating that small businesses provide retirement plans to their employees.

As state-sponsored plans become more common, several states have already passed legislation:

California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maine, Maryland, Massachusetts, Minnesota, Nevada, New Jersey, New Mexico, New York, New York City, Oregon, Rhode Island, Vermont, Virginia, Washington

SECURE Act

The Setting Every Community Up for Retirement Enhancement (SECURE) Act stands as a landmark piece of legislation regarding retirement savings in the United States.

The SECURE Act is a big deal.

It was signed into law and it is changing the way Americans approach their retirement planning, particularly at work.

It aims to address various aspects of retirement and its impact has been felt by individuals, employers, and financial institutions alike.

The SECURE Act was designed to help more Americans plan for their futures.

What are Qualifying 401k Plan Alternatives?

Already offer a retirement plan? Great! It may satisfy your state’s requirements.

Again, mandatory retirement laws by state require that you either enroll employees in your state program or offer a qualifying retirement plan.

Qualifying retirement plans may include:

- 401k plans

- SIMPLE IRA plans

- Qualified annuity plans

- Simplified Employee Pension plans

Number of Employees to Set Up a 401k Plan for Small Business

More and more retirement plan providers are offering 401k solutions tailored to small businesses. Some start at just 1 employee making it more accessible than ever!

This means you can extend the benefits of a 401k plan to your team, no matter what size.

Providing a 401k plan can be a powerful tool for attracting and retaining talent, enhancing employee satisfaction, and fostering a sense of financial security among your staff.

Whether your business has 1, 5, or 10 employees, you can contribute to their financial future through a small business 401k plan.

How Much Will a 401k Plan for Small Business Cost?

The cost of implementing a 401(k) plan varies based on factors such as company size and plan specifics.

For instance, a small business with 10 employees may expect initial setup costs between $1,400 to $5,600 for the first year. Larger businesses may pay more or less, depending on plan intricacies and service providers.

Three main expense categories comprise employer-paid 401(k) fees:

- Setup Costs: Initial fees for establishing the plan and educating employees generally range from $500 to $2,000. Small businesses with under 100 employees can claim a tax credit of up to $5,000 annually for the first three years.

- Administration Fees: Third-party administrators handle day-to-day plan operations, including informational materials, statements, testing, and regulatory filings. These fees typically range from $750 to $3,000 annually, with an additional per-participant fee of $15 to $60.

- Matching Costs: Employers may opt to match employee contributions to their 401(k) plan, though it’s not mandatory. Matching amounts vary based on company policy and can offer strategic advantages in attracting and retaining talent.

The cost of setting up and maintaining a 401k plan for your small business can vary depending on factors like the plan’s complexity and the provider you choose.

When it comes to setting up a 401k plan, costs should be at the top of the list, particularly when you have a small group.

Management Fees

Traditional financial companies operate by Assets Under Management. BlackRock, the largest asset management company in the world has over $9 trillion in AUM!

Many financial companies focus strongly on this figure.

They’ll typically charge a percentage of the assets and these fees naturally get bigger along with the size of the client’s portfolio.

For a small business though, retirement plan management fees can add up quickly, but there are more affordable options.

If you have a smaller number of employees, don’t be surprised if a large bank won’t return your calls. Look at firms that specialize in small businesses.

Flat-Fee Pricing

Flat-fee pricing for small businesses can offer several advantages over traditional management fees when setting up and managing retirement plans.

Here’s a case for why flat-fee pricing is often more beneficial for small businesses:

Cost Predictability

Flat-fee pricing provides small businesses with a clear and predictable cost structure.

With traditional management fees based on a percentage of assets under management (AUM), costs can fluctuate significantly as the plan grows or experiences market fluctuations.

This unpredictability can make budgeting and financial planning challenging for small businesses, particularly those with tight budgets.

Budget-Friendly

Many small businesses operate on tight budgets.

Flat-fee pricing helps them allocate resources efficiently, ensuring that retirement plan costs don’t consume a disproportionate share of their financial resources.

This enables small businesses to remain competitive in the job market by offering valuable retirement benefits to attract and retain talent.

Suitable for Smaller Plans

Small businesses, especially those with a limited number of plan participants or lower plan assets, may find traditional management fees to be way too high. This can deter them from offering retirement benefits to their employees.

Flat-fee pricing, on the other hand, allows small businesses to access retirement plan services at a fixed, manageable cost, making it more feasible for them to provide this essential benefit.

Scalability

Flat-fee pricing encourages plan scalability without a significant increase in costs. As a small business grows and adds more employees to the retirement plan, traditional management fees can rise substantially, potentially becoming a financial burden.

Flat-fee plans remain cost-effective, supporting business expansion while maintaining budget stability.

Transparency

Flat-fee pricing is transparent and straightforward. Small business owners and plan participants can easily understand the fees they are paying, fostering trust and clarity in the retirement planning process.

In contrast, traditional management fees, which can include various hidden charges, may lead to confusion and mistrust.

Flexibility in Investment Choices

Flat-fee providers often offer access to a range of investment options, including low-cost index funds and exchange-traded funds (ETFs).

This flexibility allows plan participants to construct diversified portfolios with minimal expenses. Traditional management fees, which are tied to AUM, may discourage the inclusion of cost-effective investment choices.

Compliance and Administration Included

Flat-fee providers often bundle essential services like plan administration, compliance support, and participant education into their pricing.

This comprehensive approach simplifies plan management for small businesses, reducing the need for additional service providers and associated costs.

What Is the 401k Employer Match?

One of the attractive features of a 401(k) plan is the employer match. This is essentially free money that businesses contribute to their employees’ retirement savings.

Determining the right match for your company involves finding a balance between remaining competitive in the job market and managing your budget effectively.

How to Choose a 401k Plan Provider for Small Business

When considering starting a 401(k) for your small business, it’s essential to explore reputable providers tailored to the needs of small businesses.

Financial giants like Fidelity, Charles Schwab, and Vanguard might come to mind.

While these names bring plenty of name recognition they also bring along management fees that can have an impact on the returns of a small business 401k.

You’ll want to choose a company that can provide the type of retirement plan you want to offer, whether that’s a traditional 401(k) plan or something else.

Also take a look at the plan design to ensure that their eligibility requirements, vesting schedule, investment options and other details are appropriate for your employees.

You should evaluate the fees attached to your retirement plan.

Often, fees can vary depending on your business and the number of employees, so you will need to get in touch with each provider directly to receive a quote.

In general, look for one with a good track record, low fees, and the ability to scale as your business grows.

- Transparent Pricing: Offer competitive plans and investment fees without hidden costs to maximize returns.

- Real-Time Integration: Integrate 401(k) recordkeeping with payroll systems for error-free data management.

- Compliance Made Easy: Simplify the complex compliance process to ensure adherence to regulations.

- Fiduciary Oversight: Access administrative fiduciary oversight for added security and accountability.

- ERISA and Trustee Services: Provide ERISA bond and corporate trustee services for comprehensive plan management.

- Investment Guidance: Assist in managing investment fiduciary responsibilities and optimizing investment choices.

- Employee Advisory: Make investment advisory services accessible to employees for informed decisions.

- Customized Plan Features: Tailor plan features such as eligibility, matching, and investments to align with business goals and employee needs.

- Documenting Legal Compliance: Ensure that your plan’s terms and conditions are formally documented to meet legal requirements.

- Efficient Payroll Deductions: Collaborate with payroll providers to establish a smooth process for employee contributions, optimizing plan participation.

- Employee Education: Educate employees on the benefits of the plan and guide them on how to maximize its advantages.

- Continuous Improvement: Regularly review and adjust the plan’s performance to keep it in line with evolving business objectives.

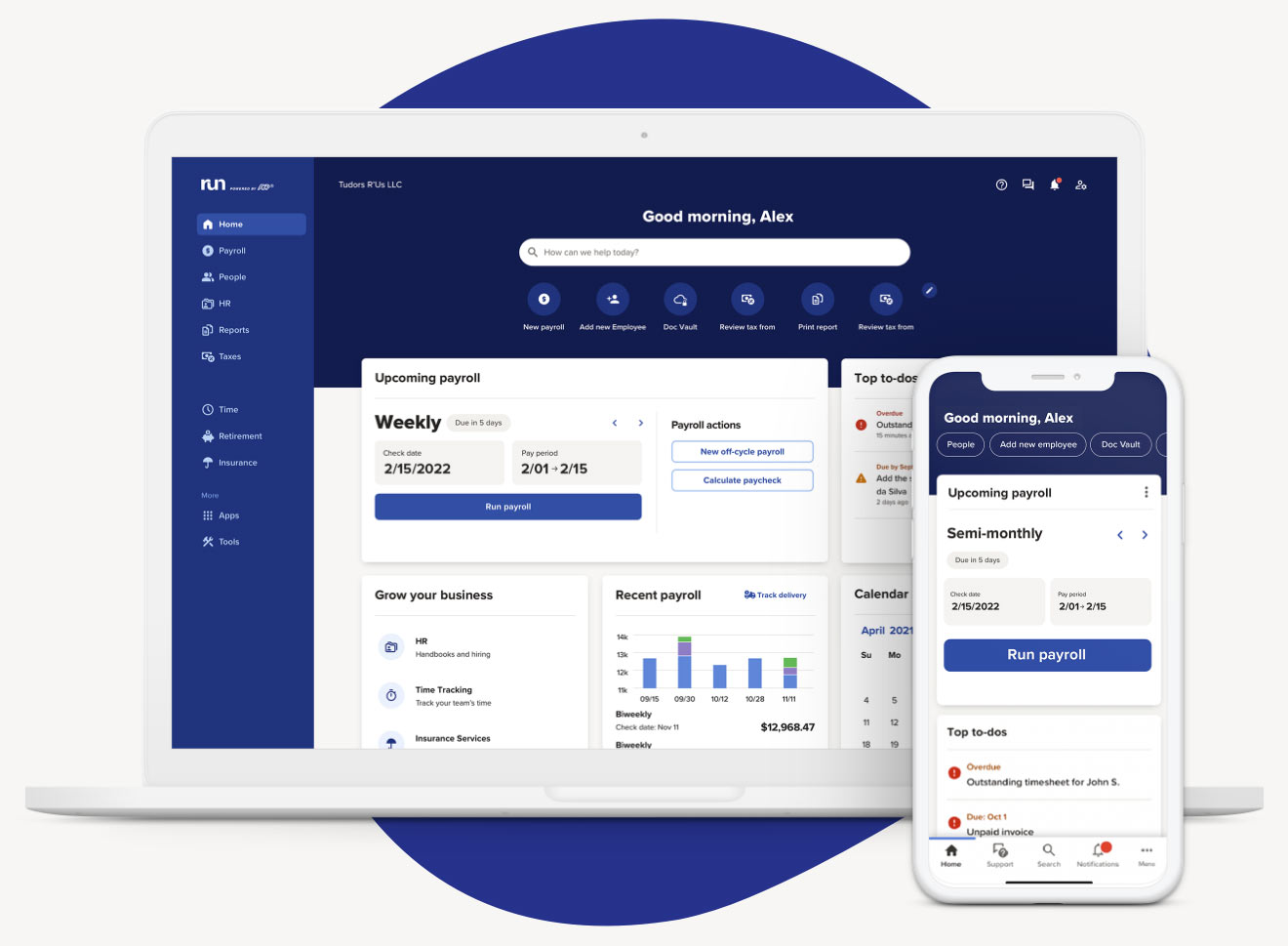

ADP

ADP stands for Automatic Data Processing. In addition to payroll & HR solutions, their 401k solutions are designed to empower small businesses by providing a valuable employee benefit without the administrative headaches often associated with retirement plans.

By aligning retirement planning with payroll, ADP enables employers to effortlessly handle contributions, monitor plan performance, and facilitate a smooth experience for both themselves and their employees.

ADP’s commitment to innovation is reflected in its user-friendly interfaces and tools, making it easy for both employers and employees to navigate and manage their 401k plans efficiently.

ADP is a partner. Contact us for details on promotional pricing.

Human Interest 401k

Human Interest specializes in 401k solutions for small and medium-sized businesses.

Known for its user-friendly platform and transparent pricing, Human Interest has done a good job of managing retirement benefits for both employers and employees — for less.

Human Interest is one of the most affordable 401k plans you’ll find for a small business. Fees are listed and they have a low minimum of just 1 employee.

They are also integrated with Gusto for a seamless payroll and administrative solution.

Human Interest is a partner. Contact us for details on promotional pricing and getting your setup fee waived.

Should I Set Up a 401k for my Small Business?

When you set up a 401k for your small business and offer it as an employee benefit you’re making a statement.

It’s a strategic move that can have a positive impact on both your business success and your employees’ financial well-being.

While offering a 401k plan involves some initial effort and costs, the benefits it brings to your business often makes it well worth the investment.

It can boost employee morale, attract top talent, and even provide potential tax advantages for your business.

In addition, a 401k helps your employees save for a secure retirement, fostering loyalty and commitment among your team.

Contact us to get started and save on your setup fees.