In this guide, we’ll walk you through the steps to find the best Maryland small business health insurance and show you how to get free assistance from a licensed broker.

There are a few options to get Maryland small business health insurance and benefits for your employees.

First, there’s the Maryland Health Connection for Small Business and the Small Business Health Care Tax Credit.

We’ll go over the difference between on-exchange and off-exchange health insurance and discuss the requirements if you’re a Maryland small business with full-time workers.

Offering affordable employee benefits is a big step for most companies, and especially a small business.

As a licensed health insurance agency and small business owner, my team specializes in helping companies like yours, whether you have 2 or 50 employees.

We make it easy, without broker fees or commissions. Click here for a sample quote.

Ted McNeil

Owner, Broker

BenZen Insurance

Licensed MD, PA, VA

Schedule A Call

What’s Inside

What Are The Requirements For Maryland Small Business Health Insurance?

The IRS and SBA have different criteria to define a small business, but when it comes to employee health insurance requirements it’s the Affordable Care Act (ACA) definition.

According to ACA, if you’re in business with less than 50 full-time employees you are not required to provide health insurance to your workers.

You can establish group health insurance with just 1 full-time employee, but this person can’t be the owner or spouse.

Additionally, if you’re looking to add dental, vision or supplemental coverage most carriers will require a minimum of 2 full-time employees for group rates.

If you have part-time employees the IRS will make you include those workers in your calculations to make sure you are under the limit.

Companies with more than 50 are required to offer health insurance.

You probably know as a Maryland small business owner, offering employee health insurance has many advantages:

Group rates, accessibility to affordable healthcare, potential tax savings and happy employees to name a few!

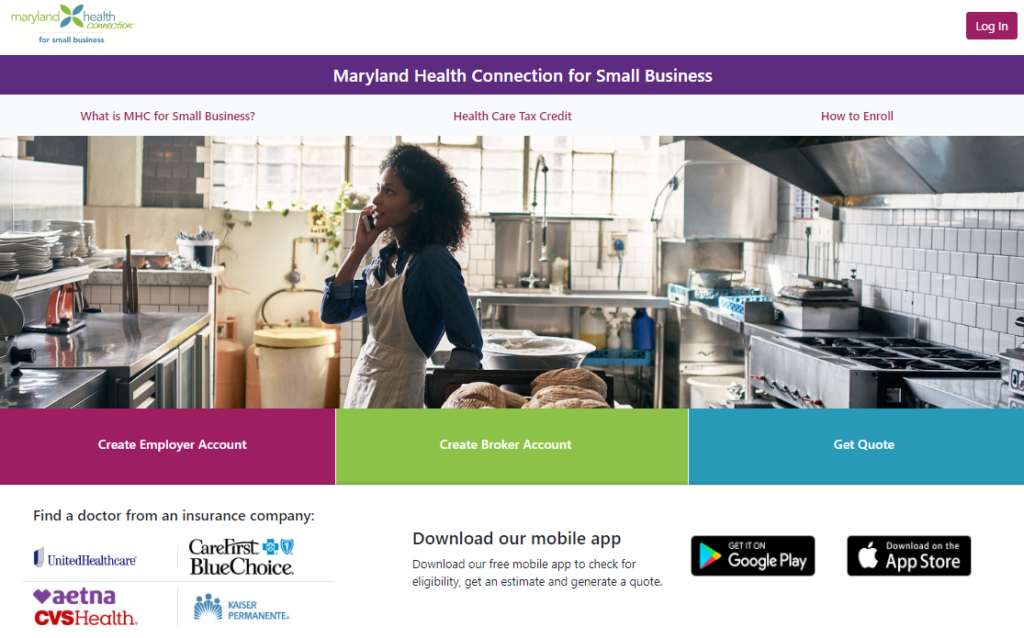

Maryland Health Connection for Small Business

Maryland Health Connection (MHC) is the state’s health insurance marketplace.

The small business portal was specifically designed to streamline the process of small business health insurance in Maryland for companies with less than 50 full-time employees.

Small business owners can self-enroll or get free assistance from licensed and certified insurance brokers that have partnered with Maryland Health Connection.

A broker can help you choose the right plans, educate your employees, help navigate the enrollment process and provide expert advice on selecting the best options for your team.

The entire process can be done online or by phone anywhere in the state!

For free personalized guidance, visit Maryland Health Connection for Small Business to get started.

MD Small Business Health Insurance Eligibility

Before you dive into small business health insurance in Maryland you’ll have to determine your eligibility:

- A principal business address in Maryland

- Federal employer identification number (EIN)

- Less than 50 full-time equivalent employees (FTEs)

- At least 1 full-time employee (not owner or spouse)

- Offer coverage to all full-time employees

In Maryland, full-time employees are those who work at least 30 hours per week.

And while you can offer group health with just 1 employee, most carriers will require a minimum of 2 employees for dental, vision & supplemental plans.

The Difference Between On-Exchange & Off-Exchange

You can offer Maryland small business health insurance on-exchange or off-exchange.

Both types are qualified health plans under the Affordable Care Act, but they differ in how they are obtained and managed.

On-exchange plans are policies purchased through a health insurance marketplace, either federal or state. In this case, it’s the Maryland Health Connection.

Off-exchange plans are policies that are purchased directly from insurance companies or through licensed brokers outside of the state health insurance marketplace.

One big difference — off-exchange plans do not qualify for subsidies or tax credits.

However, off-exchange plans sometimes provide greater flexibility in terms of plan choices, prices, provider networks and convenience.

Also, it’s important to know both categories are subject to consumer protections mandated by the Affordable Care Act such as minimum essential coverage.

These protections include coverage for essential health benefits, prohibition of discrimination based on pre-existing conditions, and limits on out-of-pocket expenses.

Insurance companies offering off-exchange plans must also comply with these regulations to ensure that consumers receive comprehensive and affordable coverage.

Do I Need to Enroll Through Maryland Health Connection?

No. You can enroll directly with an insurance carrier or broker.

However, going through Maryland Health Connection for Small Business offers several advantages:

- Plans are certified by the state marketplace and cover essential health benefits

- Brokers are vetted, certified and contracted to assist at no additional charge

- Eligibility for the Small Business Health Care Tax Credit

Again, you can shop for small business health insurance through a carrier off-exchange, but you won’t be able to claim the tax credit.

Be sure to consult with your tax advisor for more information.

As an authorized broker we are committed to making it easy to offer small business health insurance in Maryland.

Call, email or connect with us from your Maryland Health Connection account (see steps below)

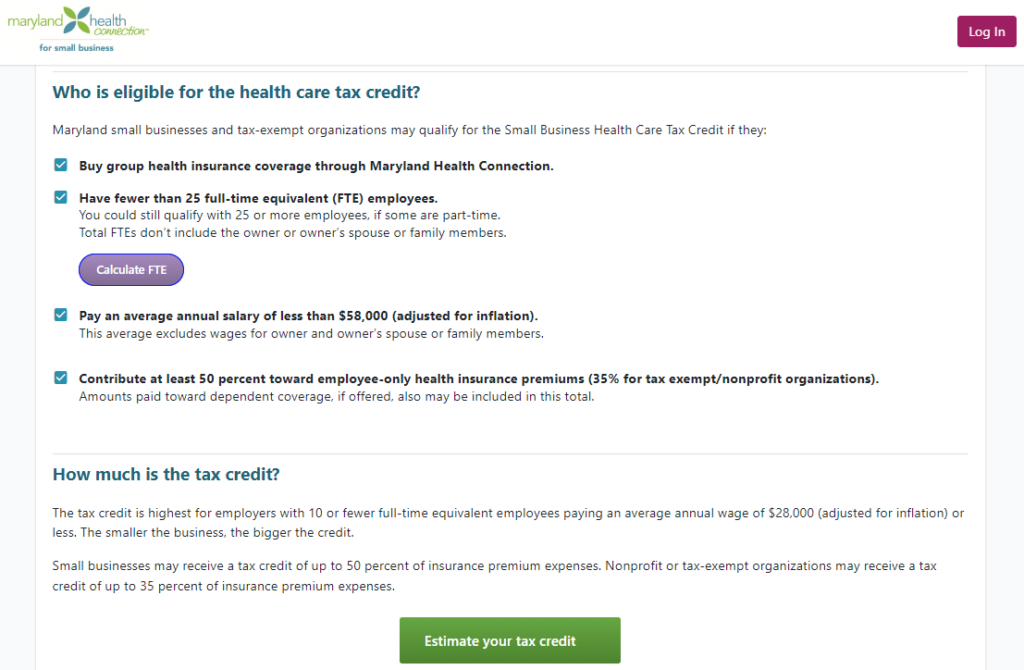

Maryland Small Business Health Care Tax Credit

Small businesses in Maryland that provide health insurance coverage to employees may qualify for a tax credit from the IRS to help lower the cost of coverage.

To be eligible for the Small Business Health Care Tax Credit, your business must:

- Enroll through Maryland Health Connection for Small Business (SHOP)

- Have less than 25 full-time employees

- Pay an average salary of less than $56,000 (as of this writing)

- Contribute at least 50% toward employee premiums

Eligibility for the Small Business Health Care Tax Credit is determined by the IRS.

You may apply for the credit only after being deemed eligible to purchase a plan through Maryland Health Connection’s Small Business Marketplace.

The tax credit may be claimed for any two consecutive years. At the end of the year, when you file your business taxes, you will fill out IRS Form 8941 to claim the tax credit.

The IRS will have the final say on how much your small business may receive.

Consult with your tax advisor for more information.

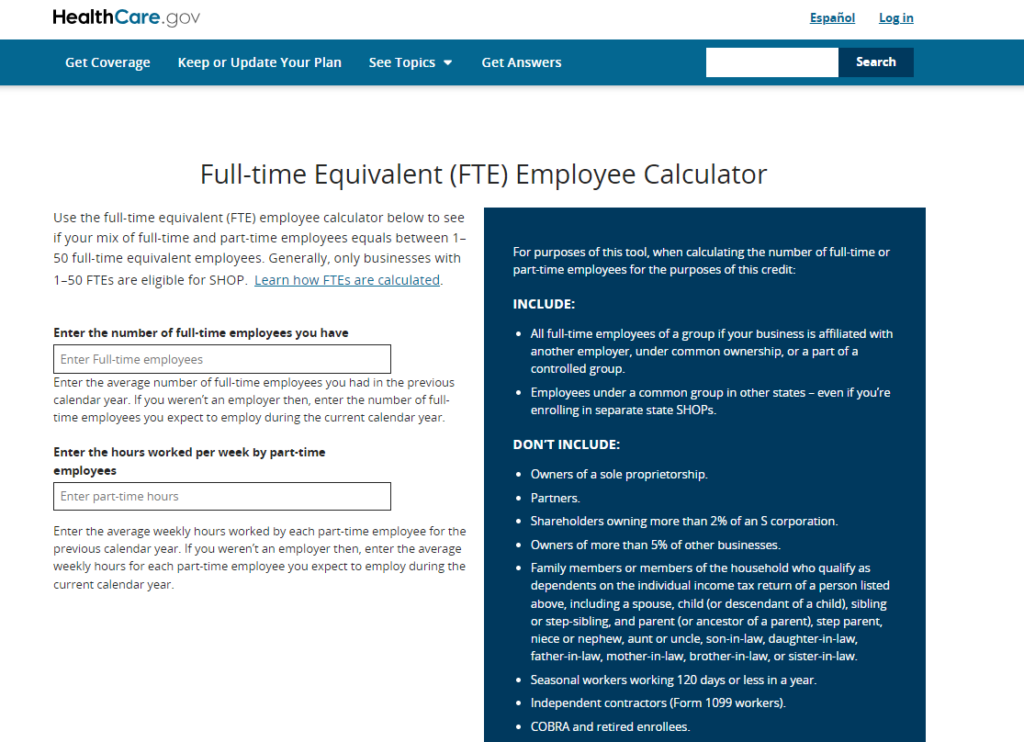

Calculating Full-Time Employees (FTE)

Ensuring that your employees are eligible for your small business’s health insurance benefits is an essential step.

Here’s how you can determine eligibility at Healthcare.gov using the FTE Calculator:

1. Define Full-Time Employees: In Maryland, a full-time employee is generally someone who works at least 30 hours per week. It’s essential to establish these criteria upfront to identify those employees who qualify for healthcare benefits.

2. Calculate Full-Time Equivalent Employees: If you have a combination of full-time and part-time employees, you’ll need to calculate full-time equivalent (FTE) employees. This calculation considers the total number of hours worked by part-time employees and adds them to the count of full-time employees.

3. Meet Minimum Participation Requirements: To participate in SHOP, your business must have at least one full-time employee (excluding the owner) who meets the 30-hour-per-week criteria.

If your business meets this requirement, you are eligible to offer health insurance coverage to your employees.

By following these steps and making use of Maryland Health Connection, you can streamline the process of securing healthcare benefits for your small business while ensuring that you meet the eligibility requirements for your employees.

This will enable you to provide valuable health coverage to your workforce, enhancing their well-being and the overall appeal of your business.

What’s the Best Maryland Small Business Health Insurance?

Choosing the best small business health insurance in Maryland depends on a few factors such as the size and location of your company, budget, employee health and personal preference.

- Different Needs: Some businesses prioritize comprehensive coverage for employees, even if it means slightly higher premiums. Others might be more budget-focused, seeking the most affordable option.

- Employee Demographics: The age and health of your employees can impact plan selection. Younger, healthier employees might need a less comprehensive plan compared to an older workforce with potentially higher healthcare needs.

- Plan Details: Beyond provider names, individual plans within each company vary significantly. Factors like network coverage, deductibles, copays, and out-of-pocket maximums all influence the overall value.

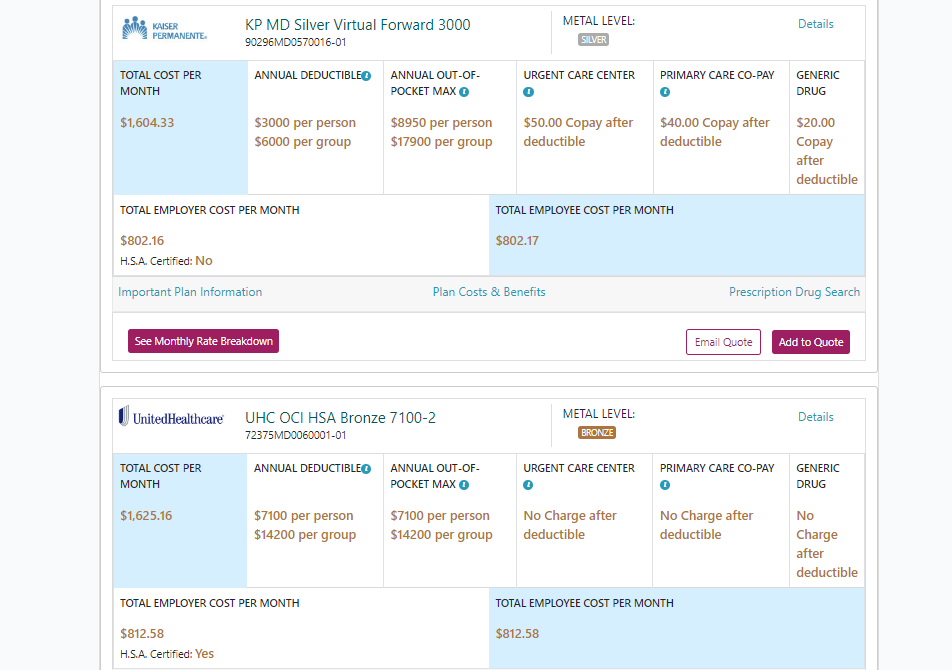

Your options for small business health insurance in Maryland include CareFirst BlueCross, Kaiser Permanente, UnitedHealthcare, and Aetna.

Each provider offers different plans with varying levels of coverage, costs, and network options.

Consulting with an insurance broker can help you compare plans & benefits to streamline the process and find the most suitable option for your company.

READ MORE:

- How To Get Group Health Insurance With Less Than 10 Employees

- What’s The Cost To Set Up A 401k For A Small Business?

Best MD Health Insurance (Network)

Look into plans offered by UnitedHealthcare. They’re known for having extensive networks of doctors and hospitals, ensuring your employees have access to a wide range of healthcare providers within the state and while traveling throughout the country.

UnitedHealthcare

Best MD Health Insurance (Price)

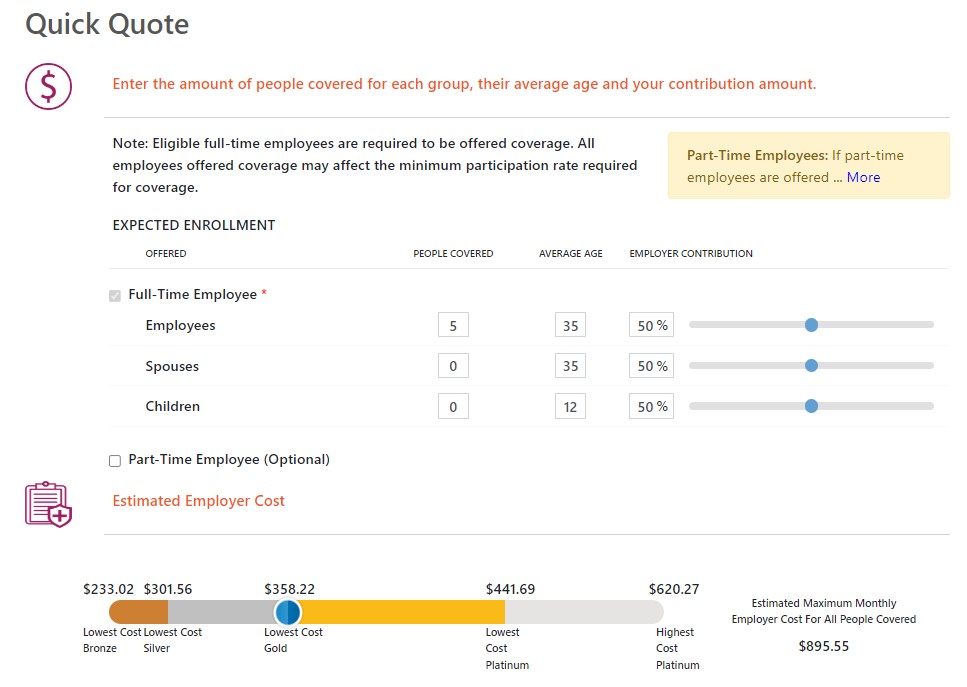

I generated a sample quote for an auto body shop (SIC 7532) with 5 employees and calculated the average rate for a Gold Plan:

| Insurance Carrier | Monthly Premium |

|---|---|

| Aetna | $625 |

| CareFirst | $680 |

| Kaiser Permamene | $575 |

| UnitedHealthcare | $650 |

Aetna has generally been our strongest plan based on affordability. They offer competitive premiums for small group plans with comprehensive coverage and are widely accepted by healthcare providers in the state.

Aetna

Best MD Health Insurance (Overall)

Kaiser Permanente consistently ranks high for customer service according to JD Power and a 5-star rating from the National Committee for Quality Assurance.

They’re known for their emphasis on patient experience and integrated care systems.

Kaiser Permanente

This list is just a starting point. Consult with a broker and get quotes to compare things like premiums, deductibles, copays, and out-of-pocket maximums.

5 Steps to Get Maryland Small Business Health Insurance

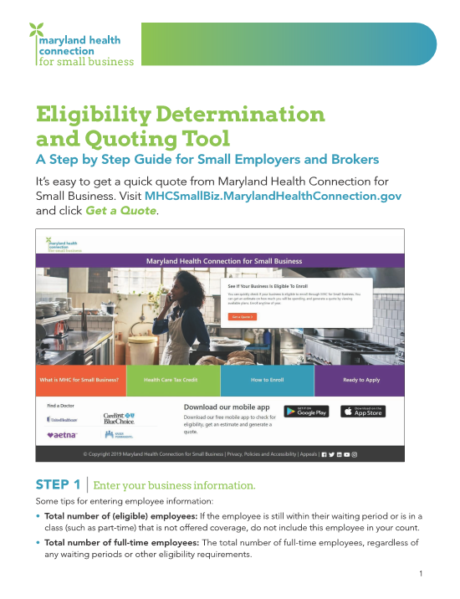

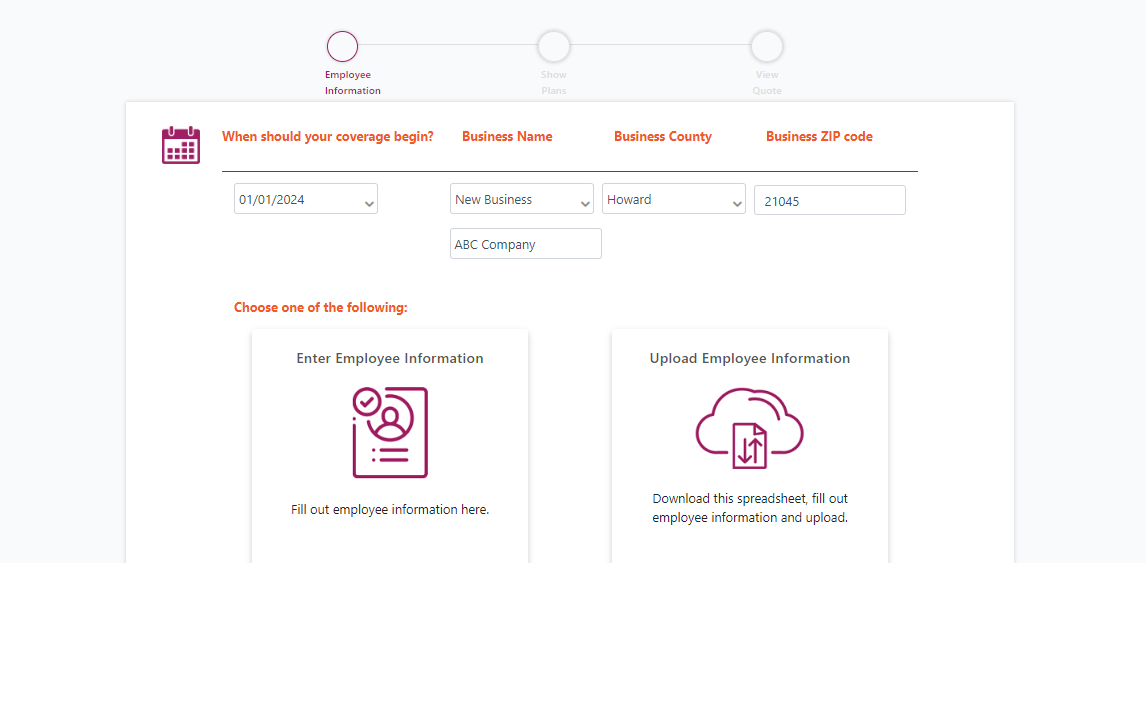

Once you confirm your eligibility, you can start shopping for health insurance plans.

As the owner, you can select one health plan (Employer Choice) or multiple plans (Employee Choice), more on this below.

You’ll also be able to add dental, vision or group life insurance based on the size of your group.

Here’s how to use Maryland Health Connection to get small business health insurance in 5 steps:

Step 1. Create An Account & Check Eligibility

The first step is to create an account for your business. You can do this at Maryland Health Connection for Small Business:

https://mhcsmallbiz.marylandhealthconnection.gov

Be prepared to provide necessary information about your business, including your Employer Identification Number (EIN).

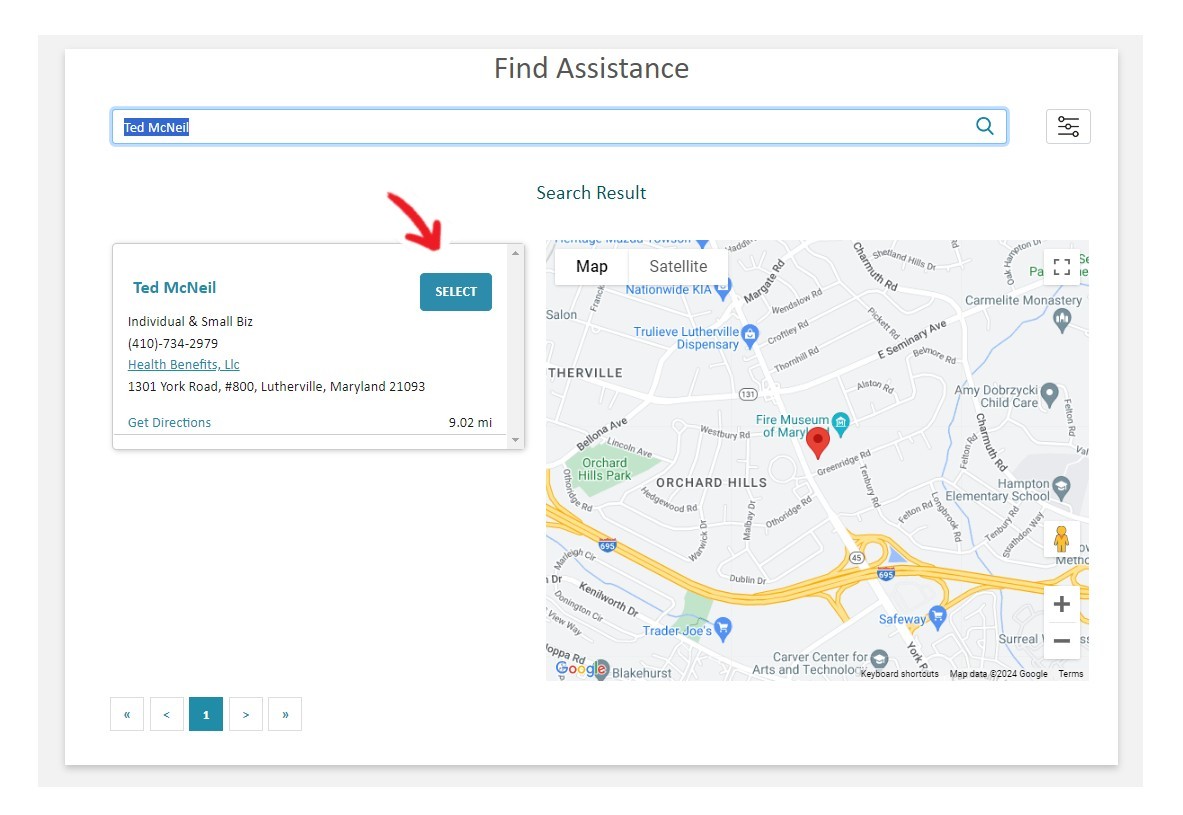

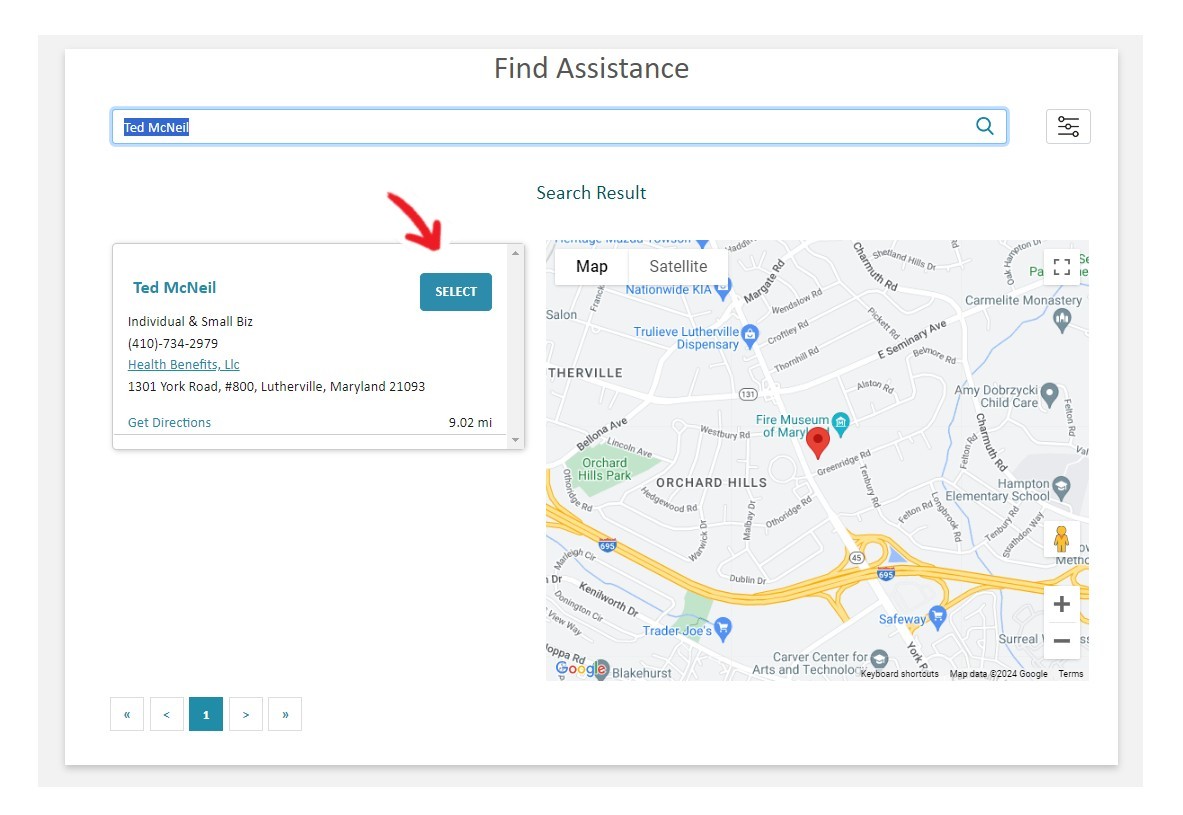

Step 2. Connect With A Broker

While it’s possible to navigate Maryland Health Connection on your own, many small business owners find it helpful to work with a licensed insurance broker to help guide them through the process.

A broker can help you understand the available plans, educate your employees, help navigate the enrollment process and provide expert advice on selecting the best options for your team!

- Plan Selection

- Benefits Consultation

- Enrollment

- Administration

Brokers that partner with Maryland Health Connection do not charge any fees or commissions and are available every step of the way.

My team specializes in Maryland small business health insurance for 2-50 employees. If you’d like to learn more, schedule a brief phone call.

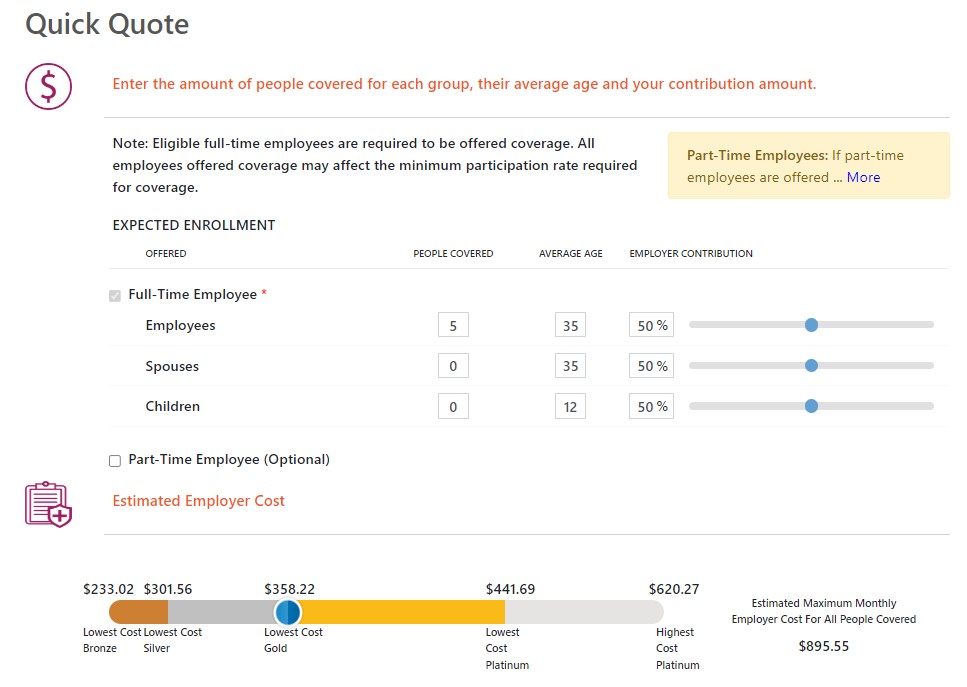

Step 3. Compare Plans

In Maryland, you’ll find qualified ACA health plans from four major carriers:

- Aetna

- Carefirst

- Kaiser Permamente

- UnitedHealthcare

Use the online tools to compare these plans, assessing factors like coverage, deductibles, and premiums.

Estimate the potential costs for your business based on your selected contribution level and determine the percentage of the premium you want to contribute to your employees’ coverage.

While you’re not required to cover the entire cost, contributions make your business a more attractive place to work.

The typical contribution is 50% for employees and is the minimum required to receive the tax credit.

Step 4. Enroll Your Small Business

Once you receive your eligibility notice it’s up to you how to proceed. You can manage the process yourself or have an agent or broker assist.

Once you decide on an insurance carrier you’ll receive a proposal. Choose how to offer coverage:

Employer Choice: You select one insurance company that offers coverage through the SHOP, and employees may choose any SHOP plan across any metal level that insurance company offers.

Employee Choice: You select one metal level of coverage, and employees may choose any SHOP plan across all the insurance companies that offer plans at that metal level.

Step 5. Enroll Your Employees

After selecting your health plan, you’ll finalize the group creation with the carrier or work with your broker to facilitate the enrollment process for your employees.

Maryland Health Connection makes it relatively straightforward to add employees, provide them with access to the selected plans, and manage the administrative aspects of your health benefits.

Get Free Broker Assistance!

Navigating Maryland small business health insurance is a lot easier when you have the right information and resources at your disposal.

Providing benefits to your employees not only helps them lead healthier lives but also strengthens your business.

If you’re a small business owner, take advantage of the free resources at Maryland Health Connection:

- Calculate Full-Time Employees (FTE)

- Get a Preliminary Quote

- Connect with a Licensed Certified Broker

Start an estimate, determine your contributions, and enroll in a plan that meets your unique needs and the needs of your employees.

If you have any questions contact us.

Ted McNeil

Owner, Broker

Schedule A Call

410-734-2979 (Mon-Fri, 9am-6pm)

888-488-3321

BenZen Insurance

Licensed MD, PA, VA

Information is meant to be accurate and educational and not intended to be legal, medical or financial advice. Be sure to do your own research and contact a professional for help. Our site is free to use, but we may receive a commission from our partners & advertisers at no additional cost to you. Read our disclosure for more information.

Licensed health & life insurance broker helping individuals, families and small business owners get better access to affordable health benefits.

His background in marketing research, insurance and retirement plans gives him a unique perspective to help others plan for the future and improve their physical, mental and financial well-being.