We may receive a commission from advertisers at no additional cost to you. Read our disclosure for details.

Getting small business funding the traditional way can be a frustrating ordeal. Rules, requirements, and a lengthy approval process can leave entrepreneurs feeling disheartened.

Alternative lending changes all of that.

Unlike conventional methods, alternative lending takes into consideration a wider range of criteria making it a more accessible option for business owners, opening up new doors of opportunity.

In this post, we’ll look at the differences between traditional and alternative lending and shine a light on how these funding sources can help you get the capital you need.

How Traditional Small Business Funding Works

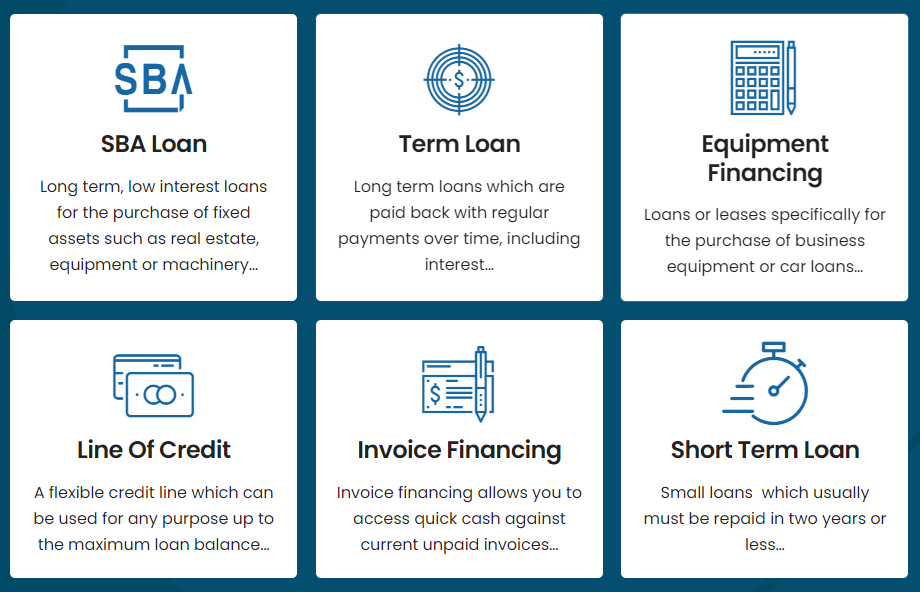

Traditional small business loans are a great source of funding — if you can make it through the application and underwriting process. Let’s take a look at how these loans work, including popular SBA-backed loans, and the steps involved.

- Research and Preparation: Understand funding needs, loan options, and eligibility criteria like term loans, lines of credit, and SBA loans.

- Application Submission: Send your loan application with business details, financial history, and loan purpose to the lender.

- Documentation and Verification: Lenders request documents (tax returns, financial statements, business plans) to verify your financial health.

- Underwriting Process: Lenders evaluate credit history, financial stability, and risks to determine loan terms and rates.

- Approval or Rejection: Based on underwriting, lenders decide to approve or reject. If approved, you receive a loan offer with details.

- Collateral and Guarantee: Some loans require collateral or a personal guarantee for security.

- Funding: Upon agreed terms, receive funds for your business needs.

- Repayment: Begin repaying as scheduled, covering principal and interest.

- Loan Completion: After final payment, your loan commitment concludes.

Traditional loans have favorable terms but come with challenges like stringent criteria, lengthy approvals, and collateral requirements.

Even with SBA-backed loans, many lenders still insist on collateral, alongside a personal guarantee, to safeguard their interests.

SBA Loan Complexity

When it comes to SBA loans there are no shortcuts. For example, the 7(a) loan program which includes their Standard, Small and SBA Express have different loan limits and different down payment requirements. The SBA sets the limits and borrowers typically have to come up with the difference:

“For most 7(a) loan programs, SBA guarantees up to 85 percent of loans of $150,000 or less, and up to 75 percent of loans above $150,000. However, SBA provides a 50% guaranty on SBA Express loans.”

https://www.sba.gov/partners/lenders/7a-loan-program/terms-conditions-eligibility#id-percentage-of-guaranty

However, one aspect that remains consistent is personal liability in case of default. If the business falls short on repayment, the borrower is legally accountable and lenders can seize pledged collateral.

In extreme cases, outstanding balances could escalate to the U.S. Treasury Department for collection.

Delays in Approval

One common grievance with traditional loans lies in the sluggish approval process. Often spanning over two months, this journey may involve communicating back and forth with SBA district offices and approved lenders.

After the lender’s initial approval, the application must undergo secondary SBA scrutiny, stretching out the waiting game.

Credit Crunch

Traditional loan paths can be challenging for applicants with low credit scores. Lenders tend to shy away from extending loans to such borrowers. Some will require business credit.

Aspiring loan applicants should strive for a personal FICO Score of 650 or more before venturing into the world of SBA loans.

While traditional small business loans serve as an established option, their intricacies and potential hurdles make them a path worth treading with vigilance.

Most important, is working with an approved SBA lender well-versed in their process.

Entrepreneurs need to be well-informed about the nuances of these loans and explore alternatives that might better align with their unique circumstances.

What is Alternative Lending?

Navigating the world of traditional bank loans can be a challenge. Banks have strict criteria that prioritize a lot of paperwork, personal and business credit, and a proven financial history.

But don’t let this discourage you! Your quest for funding doesn’t have to stop here. Alternative lending options have risen in popularity, introducing a more adaptable approach to evaluating loan applicants.

Alternative lenders, including online lending platforms and peer-to-peer networks, look beyond your credit score and available cash. They consider a wider range of factors, such as your business plan, potential income streams, industry expertise, and the overall feasibility of your venture.

Exploring these alternatives can significantly enhance your chances of securing the funding you need.

Let’s explore some examples of alternative lending options that cater specifically to the needs of small businesses.

Online Lending

In the constantly evolving financial landscape, online lending platforms have emerged as vibrant alternatives to traditional banks. They present a more user-friendly and efficient method to obtain financing, adapting to the evolving needs of a dynamic workforce:

Operating similarly to loans from traditional banks and credit unions, online lenders provide a streamlined pathway to secure financing. They often boast more lenient qualification criteria than major banks and tend to process funding requests at a swifter pace.

However, it’s worth noting that these conveniences might come at the expense of slightly higher interest rates and shorter repayment windows.

These online lending platforms offer a wide array of business loan options, catering to various needs. Among the familiar choices like term loans and lines of credit, they also provide unconventional selections such as invoice factoring and merchant cash advances.

- Faster Application Process: Online lenders boast a quicker and more efficient application process. The digital nature of these platforms enables applicants to submit documents and information swiftly, expediting the approval timeline.

- Quicker Funding Turnaround: Speed is a defining feature of online lending. For entrepreneurs who need funds promptly, online lenders can deliver quicker funding compared to traditional banks’ longer processing times.

- Alternative Criteria: These platforms often prioritize your business plan, projected revenue, and industry expertise over traditional employment. This makes them more open to considering unconventional entrepreneurs.

- Competitive Interest Rates: Due to the online competition and efficiency, online lenders frequently offer competitive interest rates, making them attractive to those looking to secure funds without a traditional job.

Big Think Capital has firmly established itself as a prominent and sought-after lending platform, dedicated to addressing the unique financial requirements of small businesses.

With a profound understanding of the challenges faced by emerging enterprises, Big Think Capital stands out for its commitment to providing tailored lending solutions that fuel growth and innovation.

Big Think Capital is an online lender specializing in small business lending

Peer-to-Peer (P2P) Lending

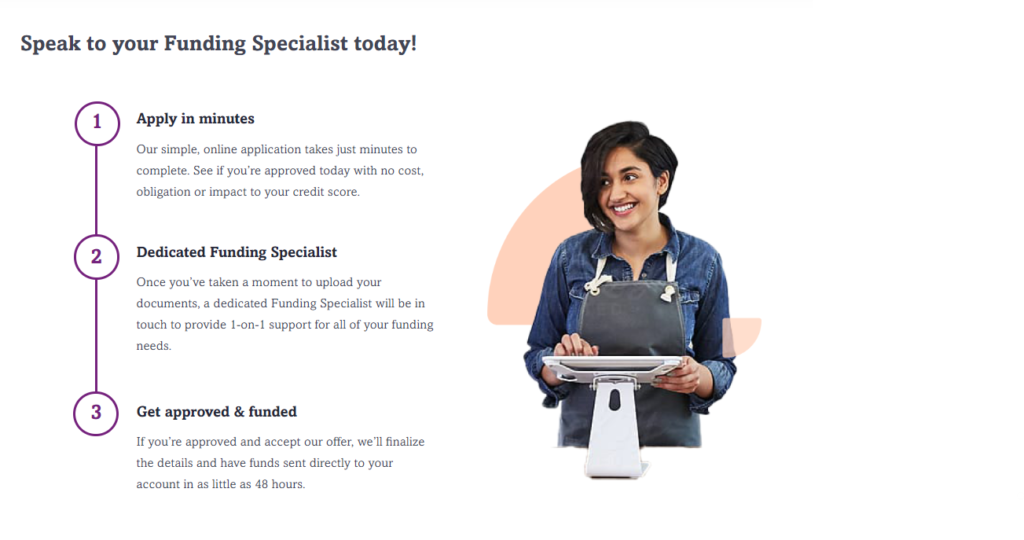

Peer-to-peer platforms like Funding Circle are shaking up how loans work by directly linking borrowers with individual investors. P2P business funding has gained popularity for its personalized touch:

- Connecting You with Investors: Platforms like Funding Circle let you directly engage with potential investors who are keen on backing promising business ideas.

- Looking Beyond Traditional Measures: When you’re dealing with Funding Circle investors, they’re interested in more than just your regular job. They want to know about your business concept, financial plans, and overall strategy.

- Open-Minded Evaluation: Funding Circle’s P2P lending approach is open to considering unique business models. This is great news for freelancers, self-starters, and those who don’t fit the traditional job mold.

Upstart and Supermoney are also known for fast P2P loans.

Crowdfunding

Crowdfunding has revolutionized the way businesses and individuals raise funds for various projects and ventures.

Online platforms like Kickstarter and GoFundMe have become household names in the realm of crowdfunding.

- Community Funding: Crowdfunding relies on the collective support of a community, enabling businesses to gather small contributions from a large number of backers.

- Diverse Project Funding: Crowdfunding is suitable for a wide range of projects, from product launches to creative endeavors and charitable causes.

- Reward-Based Crowdfunding: Platforms like Kickstarter allow businesses to offer rewards or incentives to backers in return for their support, making it an innovative way to engage potential customers.

- Equity Crowdfunding: In some cases, businesses offer equity shares in exchange for crowdfunding contributions, allowing backers to become partial owners of the business.

While crowdfunding can be an excellent avenue for raising funds and engaging a community, it may require effective marketing and a compelling story to attract backers.

Find Alternative Lending for Your Business

The landscape of alternative lending is rich with innovative options that diverge from traditional bank loans, providing small businesses with tailored solutions to their financial needs.

Online lending platforms offer accessibility, speed, and flexible qualifications, although it’s crucial to weigh potential downsides like higher interest rates. Visit Big Think Capital >>

Peer-to-peer lending establishes direct connections between borrowers and individual lenders, diversifying the funding pool. Visit Funding Circle >>

Crowdfunding has revolutionized community-driven funding, allowing businesses to engage backers through creative projects and even equity offerings. Visit Kickstarter >>

As small businesses continue to evolve, these alternative lending avenues stand as compelling pathways to securing the funds needed for growth.

By navigating this landscape thoughtfully and strategically, entrepreneurs can harness the power of alternative lending to drive their business ambitions forward.

Information is meant to be accurate and educational and not intended to be legal, medical or financial advice. Be sure to do your own research and contact a professional for help. Our site is free to use, but we may receive a commission from our partners & advertisers at no additional cost to you. Read our disclosure for more information.

Licensed health & life insurance broker helping individuals, families and small business owners get better access to affordable health benefits.

His background in marketing research, insurance and retirement plans gives him a unique perspective to help others plan for the future and improve their physical, mental and financial well-being.