In the many states we serve, self-employed dental insurance has become one of our most requested benefits. But which is the best dental plan when you work for yourself?

There are over 16 million workers in the United States who fall under self-employment.

And part of being the boss means having the best dental insurance so your business doesn’t skip a beat.

However, it also means asking a lot of good questions like:

- What’s the difference between Marketplace dental insurance vs. off-exchange dental insurance?

- How much does self-employed dental insurance cost?

- Which dental plans have the highest annual benefits?

At BenZen, we help entrepreneurs like you every day find affordable benefits & peace of mind.

Whether you’re a freelancer, independent contractor, or consultant you’re in the right place to find the best self-employed dental insurance online with free assistance and no obligation.

Available: FL, GA, MD, MI, MS, NC, PA, SC, TN, TX, VA

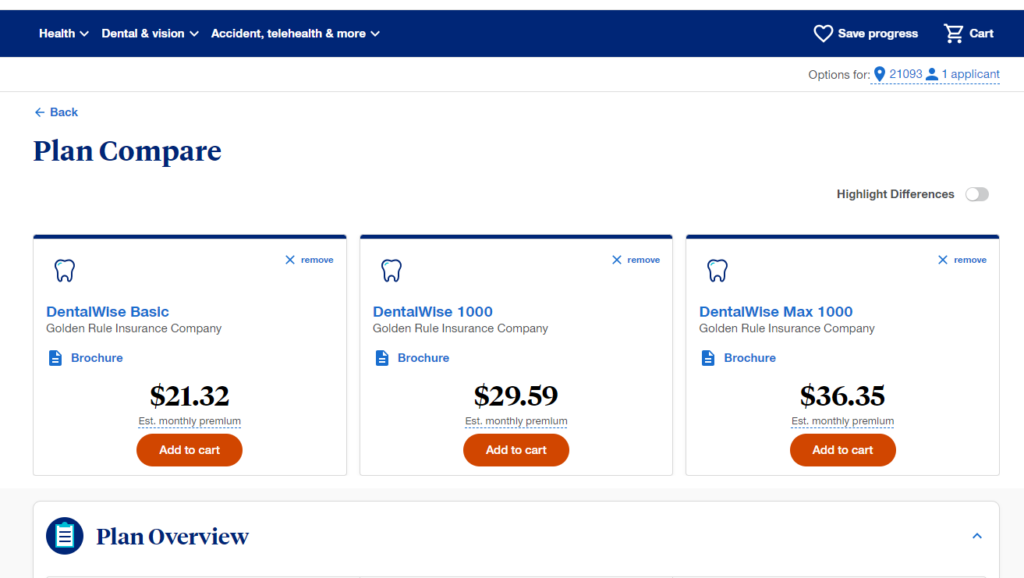

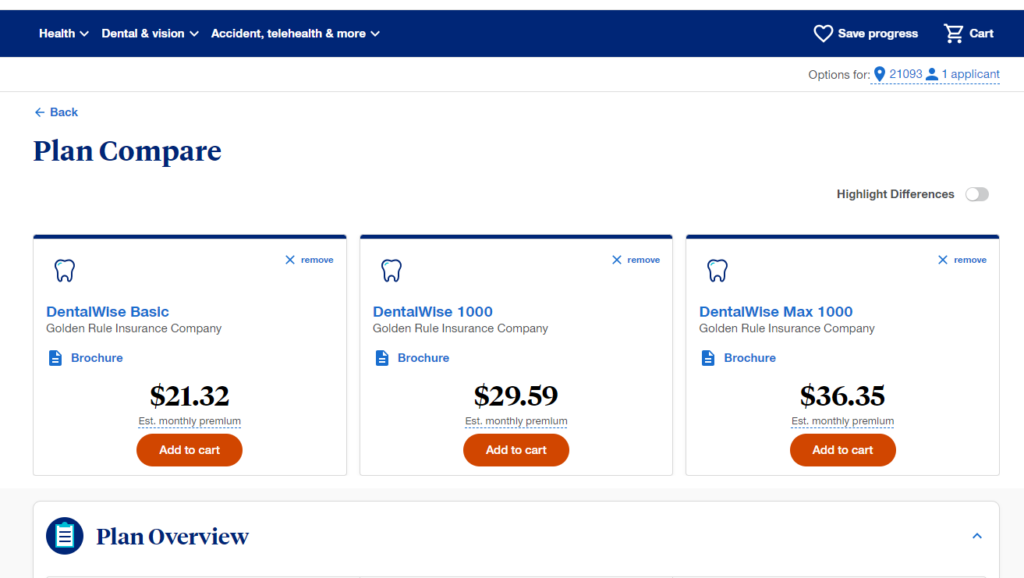

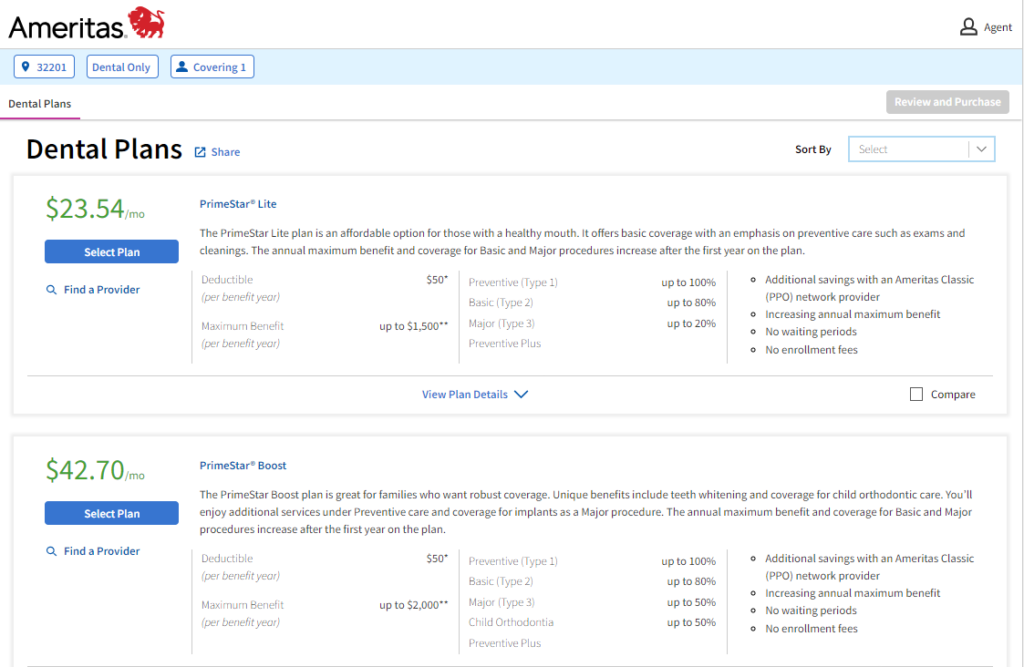

#1 – UnitedHealthcare DentalWise

UnitedHealthcare dental plans have become widely popular with their new DentalWise & DentalWiseMax products.

High annual maximum benefits up to $3,000, no waiting period, day 1 coverage and increasing benefits.

Highlights:

- DentalWise Max plans include vision (and hearing in most states).

- DentalWise 2000 covers implants with a separate $1,500 benefit.

- DentalWise Max 3000 has one of the highest annual benefits of any self-employed dental plan on the market.

DentalWise

Affordable dental only coverage from UnitedHealthcare with no waiting periods.

Brochure (pdf)

$20

Estimated monthly starting price.

✓

Dental Only

✓

DentalWise Basic

✓

DentalWise 1000

✓

DentalWise 2000

✓

No Waiting Periods!

DentalWise Max

The convenience of dental & vision in one plan! Higher benefits. No waiting periods.

Brochure (pdf)

$35

Estimated monthly starting price.

✓

Dental & Vision (plus Hearing)

✓

DentalWise Max 1000

✓

DentalWise Max 2000

✓

Coverage On Day One!

Free Assistance!

We are an independent insurance agency and make it easy to find affordable health plans & benefits for individuals, families, self-employed & small business.

No broker fees. No obligation.

Insurance plans may have limitations. Always review the policy before enrolling. If you have any questions, please contact us for a free consultation!

Licensed: FL, GA, MD, MI, MS, NC, PA, SC, TN, TX, VA

How Self-Employment Dental Insurance Works

Most dental insurance plans work like a membership: you’ll pay a monthly premium for access to a network of doctors that offer services at a negotiated price.

While you don’t need insurance to see a dentist, having a comprehensive plan can help you save money, especially for more expensive procedures.

Dental visits can be expensive without insurance. Depending on where you live a checkup might cost $100-$200. Expect to pay more if you haven’t been in a while.

And a single tooth implant will cost you $3,000-$5,000 without insurance. Ouch!

It’s easy to see how dental insurance could help you financially to keep your business on track, but there are things to remember when shopping.

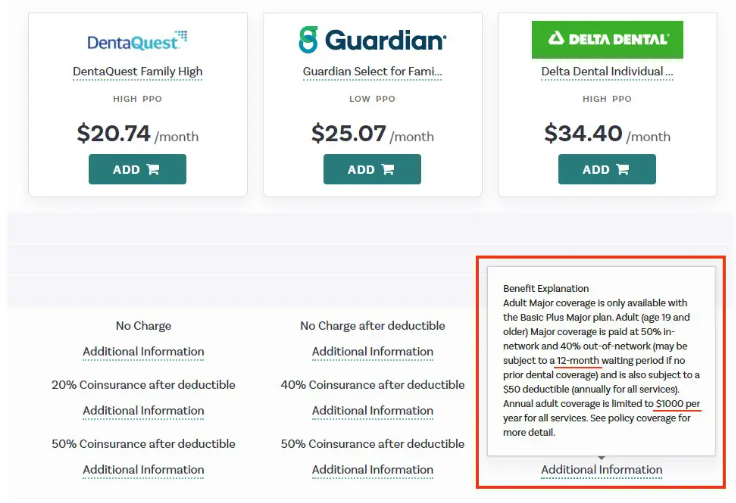

Example 1: Marketplace Dental Plan

Waiting Periods

Many dental insurance plans have waiting periods of 6 or 12 months depending on the work you need done.

These can be frustrating, but waiting periods help keep prices low for everyone else.

Waiting periods help to discourage people in poor health from purchasing dental insurance, getting work done and immediately canceling their policy.

Annual Maximum

This is the total amount your insurance company will pay towards covered dental services in a year.

Unlike health insurance, there is a “cap” or a maximum on what your carrier will pay annually.

Once you reach this limit, you’re responsible for the remaining costs for the rest of the year.

Coinsurance

Once the deductible is paid, you’ll share the remaining cost with your insurance company based on the procedure.

This cost-sharing is usually a percentage up to the annual maximum benefit.

Marketplace Dental vs. Off-Exchange Dental

With self-employment dental plans there are two main options for purchasing dental insurance:

- Marketplace Plans: These plans are available through your state’s health insurance exchange.

They are typically affordable and ideal for preventive care like checkups and cleanings.

However, they often have waiting periods of 6-12 months for major procedures and there are restrictions on when you can enroll.

- Preventative (exams, cleanings): no waiting period

- Basic (filling, simple extraction, etc): 6-month waiting period

- Major (dentures, crown, implants): 12-month waiting period

- Enrollment: only during Open Enrollment or Special Enrollment

- Annual Maximum: generally $700-$1,000

- Implants: some plans

Example 2: Marketplace Dental Plan

| Category | Plan Pays | Waiting Period |

|---|---|---|

| Preventative | 100% | No |

| Basic | up to 80% | 6-months |

| Major | up to 50% | 12-months |

2. Off-Exchange Plans: Purchased directly from insurance carriers & brokers. These plans offer more flexibility but may come with a higher premium.

The top plans have no waiting periods and day 1 coverage for expensive procedures. Ameritas and UnitedHealthcare are two of our most popular off-exchange dental plans.

- Preventative (exams, cleanings): no waiting period

- Basic (filling, simple extraction, etc): 60% on day 1; 80% after 12-months

- Major (dentures, crown, implants): up to 20% day 1; 50% after 12-months

- Enrollment: any time of year

- Annual Maximum: generally $1,000-$3,000

- Implants: most plans cover 50% after 12 months at $1,500-$2,000

Example 3: Off-Exchange Dental Plan

| Category | Day 1 | 12-months | Waiting Period |

|---|---|---|---|

| Preventative | 100% | 100% | no waiting period |

| Basic | 60% | 80% | no waiting period |

| Major | 15%-20% | 50% | no waiting period |

| Implants | n/a | 50% | 12-months |

Why Self-Employed Dental Insurance Is Important

When you work for yourself, any health issue can hurt cash flow and your teeth are no exception.

Read this guide to find the best dental & vision insurance for self-employed and protect your bottom line!

Oral health is easily overlooked when you’re running a business. Ignoring a toothache or putting off routine dental exams can lead to bigger, more expensive problems down the road.

- Peace of Mind: Regular checkups and cleanings are vital for maintaining oral health. Having coverage allows for proactive care without worrying about immediate costs.

- Financial Protection: Unexpected dental emergencies can hurt your bottom line. Insurance helps manage these costs, preventing significant financial burdens.

- Improved Overall Health: Untreated dental issues can affect your overall well-being. Dental insurance encourages preventative care, contributing to better health.

Factors to Consider When Choosing a Self-Employed Dental Plan in Florida & Georgia

With numerous plans available, consider these key factors to make an informed decision:

- Coverage: Analyze the types of procedures covered (preventative, basic, major). Do you prioritize preventative care or anticipate needing major work?

- Network: Does the plan offer in-network providers near your location in Florida or Georgia? In-network providers typically offer lower costs compared to out-of-network options.

- Cost: Compare monthly premiums, deductibles (amount you pay upfront before insurance kicks in), and co-pays (fixed amounts you pay for specific services).

- Waiting Periods: Some plans have waiting periods for major procedures. Consider “no waiting period” plans for quicker access to essential care.

- Maximum Annual Coverage: This is the maximum amount the insurance company will pay for covered services in a year.

Available: FL, GA, MD, MI, MS, NC, PA, SC, TN, TX, VA

Unlike Marketplace plans with limited enrollment periods, off-exchange dental plans offer the freedom to enroll any time of the year.

Plus, the most popular dental plans have high annual maximums, increasing benefits and no waiting period for preventative, basic and major procedures.

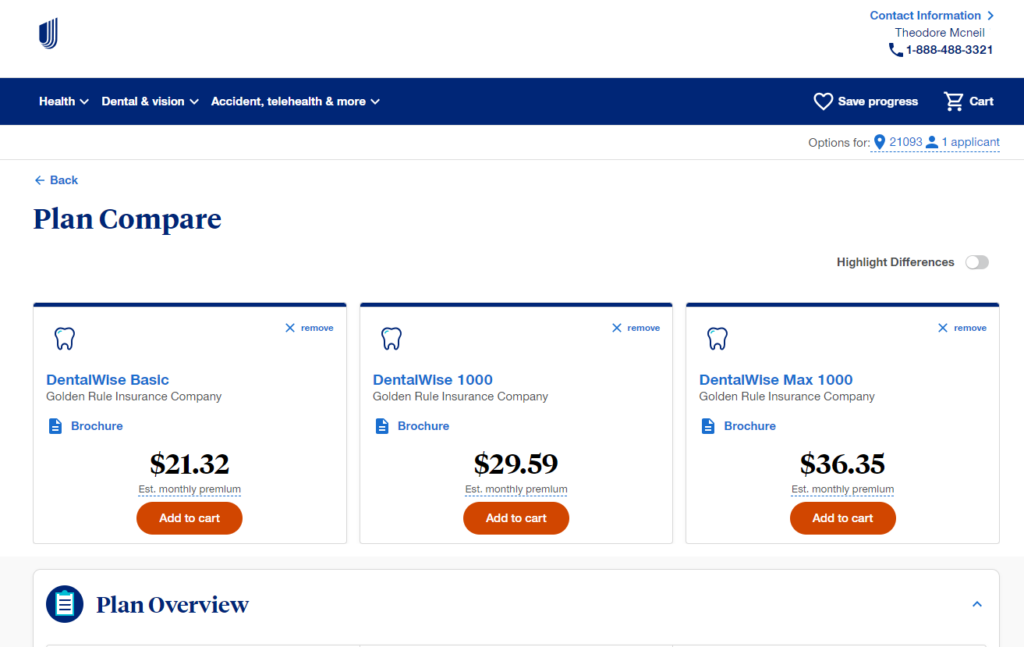

#2 – Ameritas Primestar

How Much Does Self-Employment Dental Insurance Cost?

What you pay for self-employed dental insurance will vary and depends on a few key factors:

- Location, Location, Location: Dental costs vary by region. So, where you live plays a big role in determining the premium.

- Age is a Factor: Similar to other insurance types, your age can influence cost. Generally, younger individuals pay less as they’re statistically less likely to require major dental procedures.

- Picking Your Plan: The type of plan you choose significantly impacts the price. Plans with higher annual coverage limits typically come at a premium compared to those with lower limits.

Self-Employment Dental Insurance in Florida

| City | DentalWise Basic | DentalWise Max 1000 |

|---|---|---|

| Jacksonville | $20.00 | $37.00 |

| Tampa | $20.00 | $37.00 |

| Miami | $27.00 | $45.00 |

Self-Employment Dental Insurance in North Carolina

| City | DentalWise Basic | DentalWise Max 1000 |

|---|---|---|

| Charlotte | $25.00 | $35.00 |

| Fayeteville | $25.00 | $35.00 |

| Durham | $25.00 | $35.00 |

Self-Employment Dental Insurance in Georgia

| City | DentalWise 1000 | DentalWise Max 3000 |

|---|---|---|

| Athens | $25.00 | $40.00 |

| Savannah | $25.00 | $40.00 |

| Villa Rica | $27.00 | $45.00 |

Self-Employment Dental Insurance in Texas

| City | DentalWise 1000 | DentalWise Max 2000 |

|---|---|---|

| Dallas | $29.00 | $35.00 |

| Houston | $29.00 | $35.00 |

| San Antonio | $29.00 | $35.00 |

Self-Employment Dental Insurance in Virginia

| City | DentalWise Basic | DentalWise Max 3000 |

|---|---|---|

| Richmond | $21.00 | $50.00 |

| Norfolk | $21.00 | $50.00 |

| Charlottesville | $21.00 | $50.00 |

The Best Self-Employment Dental Insurance

Here are a few things to consider when shopping for the best self-employed dental insurance.

You can purchase private dental insurance any time of the year directly from the insurance company or licensed broker.

In other words, you’re not restricted to the annual enrollment period.

Additionally, when shopping for coverage don’t focus solely on price. Compare:

- Waiting Periods

- Maximum Annual Benefits

- Coinsurance

- Provider Network

Compare waiting periods, annual benefit maximums, and covered procedures.

Make sure the plan you choose offers the help you need when you need it.

If your plan has a waiting period, keep in mind you’ll need to prepare 6-12 months in advance to use those benefits.

Our most popular dental plans don’t require income verification, occupation or health questions. And we made it easy to quote and enroll on your own 24 hours a day, 7 days a week.

If you need assistance we’re happy to help at no additional charge!

Looking for Small Group Benefits?

If you have 2-50 employees, contact us for group rates. Visit our employer page to learn more.

Start A Quote!

UnitedHealthcare

From one of the best known names in healthcare, affordable solutions to protect your important assets. Their large network is widely accepted throughout the country.

UnitedHealthcare dental plans provide flexible options for basic and major dental services with no age limit, no waiting period, day 1 coverage and increasing benefits.

Preventive, basic and major services covered. Annual maximums from $1,000-$3,000.

Popular plans: DentalWise 1000, DentalWise Max 1000 (covers vision) and DentalWise 2000 (covers implants)

DentalWise Max plans include vision. DentalWise 2000 covers implants with a separate $1,500 benefit (12-month waiting period applies to implants. No waiting period on all other services)

- DentalWise 1000

- DentalWise Max 1000 (& vision)

- DentalWise 2000 (covers implants with additional $1,500 benefit)

- DentalWise Max 2000 (& vision)

- DentalWise Max 3000

Insurance plans may have limitations. Always review the policy before enrolling. If you have any questions, please contact us for a free consultation!

Available in: FL, GA, MD, MI, MS, NC, PA, SC, TN, TX, VA

Ameritas Dental

Ameritas PrimeStar® dental insurance plans feature next-day coverage and no enrollment fees.

There are no waiting periods on most dental plans and no enrollment fees when you sign-up online.

Preventive visits, such as dental exams and cleanings, are covered up to 100%.

Fillings and extractions are covered in Basic services. Crowns, implants, dentures and teeth whitening are covered in Major services with PrimeStar Access.

Select plans include additional benefits such as vision, LASIK, orthodontia, or hearing care. Check your ZIP Code for availability.

- PrimeStar Lite

- PrimeStar Boost

- PrimeStar Complete

- Annual maximums from $1,500-$3,000

- Increasing Benefits

- Child Orthodontia

Insurance plans may have limitations. Always review the policy before enrolling. If you have any questions, please contact us for a free consultation!

Available in: FL, GA, MD, MI, MS, NC, PA, SC, TN, TX, VA