Understanding your options for employee benefits, especially group health insurance for your small business, is crucial for attracting and keeping great people. A common question we hear is:

“Can my small business get health insurance with just 1-2 employees?”

Generally, the answer is yes. Most insurance carriers do offer group health insurance even for very small teams, typically starting with two employees.

However, there are key considerations we’ll discuss in this article.

How Small Group Health Insurance Works

The availability of group health insurance is a big deal for small businesses, allowing you to offer valuable benefits that can attract and retain talent.

While many carriers will establish a group with at least two employees (and sometimes even one, depending on the state and specific rules), there’s a key consideration: the “second” employee usually needs to be a non-family member.

This rule prevents coverage from simply being a “family” plan at a group rate.

It’s also important to know that while you can get group health insurance with just two employees, the cost benefits aren’t always what you might expect.

Group rate discounts are often directly related to the number of employees. With just two, exploring the individual marketplace can sometimes be more affordable.

So, while group health insurance may be an option, let’s dig into the details to help you make the best choice for your business. We’ll compare group health insurance costs in a moment.

Questions? As an independent agency, we make it easy for small businesses to get affordable health plans and benefits.

Get a quote with free personalized guidance from a licensed expert.

Size Matters: The Cost of Group Health Insurance

One of the key considerations for small business owners is the cost of group health insurance.

It’s worth noting upfront that according to [insert source here – e.g., the Small Business Administration or a relevant government website], businesses with fewer than 50 employees aren’t legally required to offer health insurance.

Now, when it comes to actually setting up a group plan, especially for a small team like two employees, it’s a common assumption that you’ll automatically get big discounts. While the idea of group buying power exists in the insurance world, the reality for very small businesses isn’t always a significant price reduction. Often, the “group rate” for just two people might not be much different, or even could be higher, than what those individuals might find on the individual health insurance marketplace.

The way insurance carriers calculate premiums is based on the overall health risk of everyone enrolled in the plan. In larger groups, this risk is spread out among more people, which can lead to more stable and potentially lower costs per employee.

However, with just two employees, the health of each person has a much bigger impact on the premium. If one of your two employees has a major medical event, it can unfortunately lead to a more noticeable increase in your group’s rates down the line.

Think of it like this: imagine a big bucket for a company with 100 employees and a small bucket for your company with two. If someone in the big bucket has a costly medical issue, the expense is spread across 100 people. But if that same thing happens to one of your two employees, the cost is only spread between two, making the per-person impact much larger.

The main advantage at this size is often the ability to offer a structured benefits package and potentially access plan options that aren’t readily available to individuals.

Fully-Insured vs. Level-Funded

Another key factor influencing the cost of small group health insurance is the type of plan you select: fully-insured or level-funded. These differ significantly in how risk and payments are structured.

Fully-Insured Plans: Traditionally the standard, fully-insured plans involve you paying a fixed monthly premium to the insurance carrier. In this model, the carrier assumes all the risk of covering your employees’ healthcare expenses. Your premium rates are primarily determined by the overall health of your employee group, the broader community or industry, and general market trends.

Consequently, fully-insured plans are often the more predictable, but most expensive option.

Level-Funded Plans: Offering a hybrid approach, level-funded plans can be particularly attractive to smaller, potentially healthier employee groups.

You’ll pay a consistent monthly amount that’s designed to cover the estimated cost of your employees’ claims, administrative fees, and a stop-loss insurance policy. This stop-loss coverage protects you from unexpectedly high claims.

By sharing some of the risk, level-funded plans often provide lower initial premium rates, sometimes significantly so.

Furthermore, if your employees’ actual healthcare claims are lower than projected, you may even receive a portion of the unused funds back at the end of the year.

The choice between a fully-insured and a level-funded plan can have a substantial impact on your costs and the level of risk your business assumes.

We can help you navigate these complexities and find the most cost-effective solution for your team.

Contact us to learn more.

The Individual Marketplace

Given the potential cost considerations of setting up group health insurance for a small business with two employees, it’s really smart to look at all your options. One important alternative is the individual health insurance marketplace, which was created under the Affordable Care Act (ACA). Here, your employees might be able to find health insurance plans that fit their specific needs and budgets.

Plus, depending on their individual income levels, your employees might also qualify for premium tax credits or subsidies through the marketplace. This financial assistance could actually make individual coverage more affordable for them than being part of a small group plan.

However, simply telling your employees to go check out the individual marketplace might not be the best approach for either you or them. For one thing, if your employees don’t already have individual coverage outside of the standard Open Enrollment period, they might face challenges enrolling.

This is where Health Reimbursement Arrangements (HRAs) and Individual Coverage HRAs (ICHRAs) become really valuable.

Offering an HRA wil trigger a Special Enrollment Period in the individual marketplace, making it easier for your employees to get coverage when they need it.

Alternatives for Small Group Health Insurance

Instead of a traditional group health insurance plan, you may want to consider Health Reimbursement Arrangements (HRAs), Individual Coverage HRAs (ICHRAs), and Qualified Small Employer HRAs (QSEHRAs).

These options offer significant tax advantages for both you as the employer and your employees.

Because these arrangements involve IRS tax rules, calculations, compliance, and reporting, many business owners choose to work with a third-party administrator, or TPA.

These specialized companies typically charge a small per-person fee to manage the HRA and ensure you stay compliant with all regulations.

We partner with companies like Take Command that offer user-friendly platforms to simplify the entire HRA process.

As a benefit for our clients, we’re able to get any setup fees waived!

Understanding the Different Types of HRAs:

- Health Reimbursement Arrangements (HRAs): An HRA is an employer-funded, tax-advantaged benefit allowing you to reimburse employees for qualified medical expenses, including individual health insurance premiums.

- While traditional HRAs often supplement a group plan, Qualified Small Employer HRAs (QSEHRAs) are specifically designed for small employers who don’t offer group coverage.

- Individual Coverage HRAs (ICHRAs): A more recent option, ICHRAs allow employers of all sizes to reimburse employees for the cost of their individual health insurance policies.

- A key advantage is the flexibility in setting contribution amounts for different employee classes. These reimbursements are typically tax-free for employees, and your contributions are tax-deductible.

- Qualified Small Employer HRAs (QSEHRAs): An excellent choice for small businesses (generally under 50 full-time equivalent employees not offering a group health plan), QSEHRAs enable you to reimburse employees tax-free for their individual health insurance premiums and other qualified medical expenses.

By exploring an HRA your small business can empower employees to choose health coverage that truly meets their individual needs, all while benefiting from valuable tax advantages.

Contact us to learn more.

What’s the Best Group Health Insurance for My Small Business?

There’s no one-size-fits-all answer to this question. The “best” option depends on a multitude of factors, including the size of your business, the health needs of your employees, your budget, and your administrative capacity.

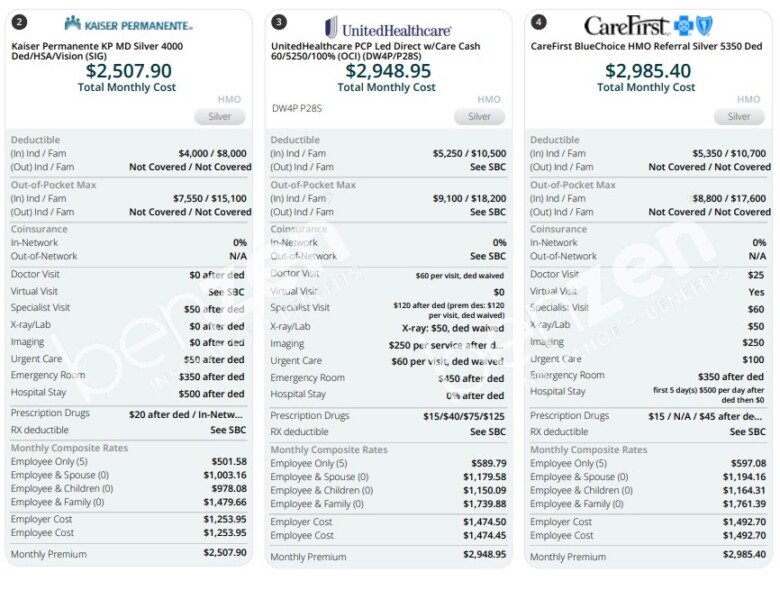

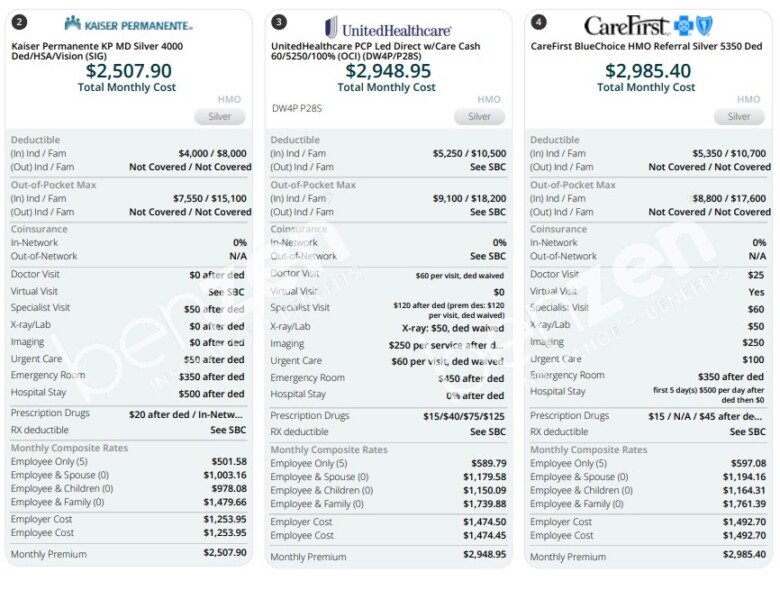

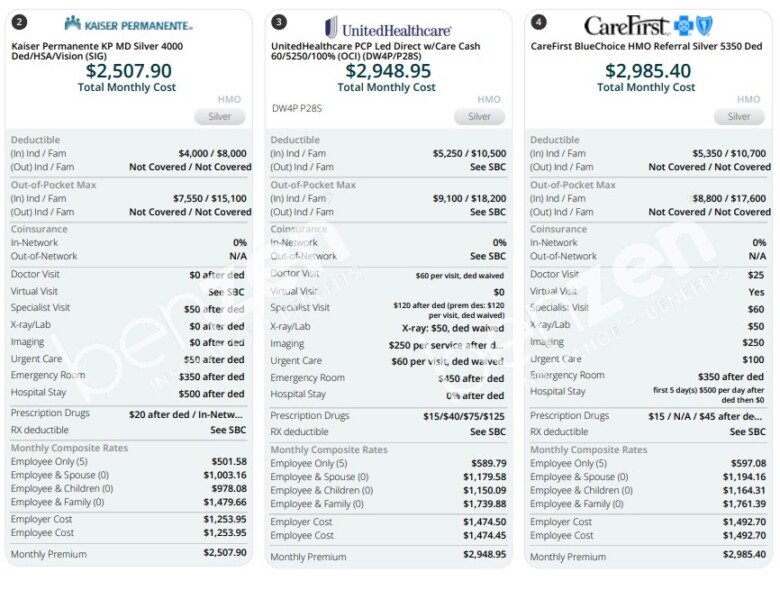

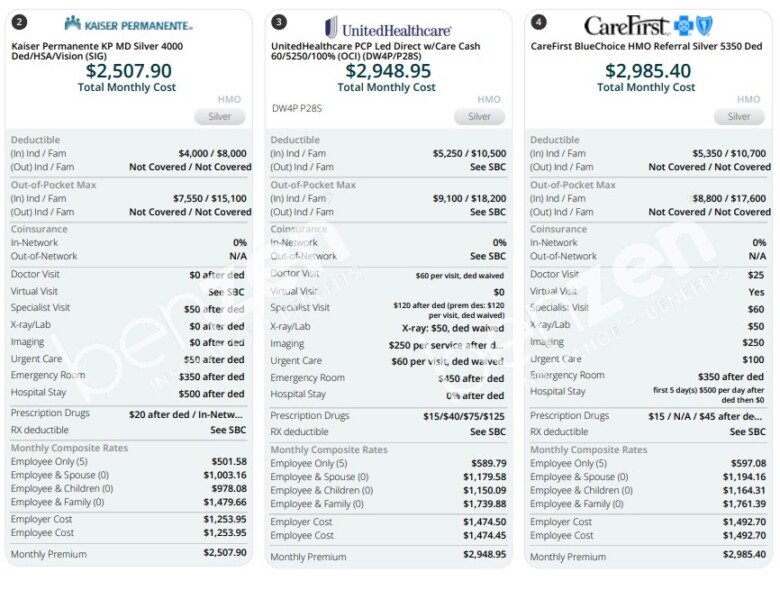

To give you a clearer picture, let’s look at hypothetical scenarios in three of our largest markets – Atlanta, Baltimore & Richmond – to get an idea of potential costs for small businesses with two versus ten employees.

Please note that the following examples are illustrative and do not represent actual quotes. Health insurance premiums vary significantly based on the specific plan, the carrier, the demographics of the employees (age, location, etc.), and the year.

We work with small businesses in our licensed states: FL, GA, MD, NC, NJ, PA, SC, TN, TX, VA

Group Health Insurance for Small Business in Georgia

Scenario 1: Two Employees

A small marketing agency in Atlanta with two young, healthy employees might find that a basic group health insurance plan with moderate deductibles and copays could cost in the range of $800 to $1,500 per employee per month.

This cost can fluctuate based on the specific plan design (e.g., HMO, PPO), the level of coverage, and the insurance carrier.

Scenario 2: Ten Employees

A slightly larger manufacturing company in Savannah with ten employees of varying ages and health conditions might see a per-employee cost in the range of $600 to $1,200 per month for a similar level of coverage.

The larger group size helps to distribute the risk, potentially leading to a lower average cost per employee compared to the two-employee scenario.

However, the overall cost for the business will, of course, be higher due to the increased number of enrollees.

Group Health Insurance for Small Business in Maryland

Scenario 1: Two Employees

A small tech startup in the Baltimore area with two employees might encounter group health insurance premiums ranging from $900 to $1,700 per employee per month for a standard plan.

Maryland’s healthcare market has its own set of regulations and cost factors that influence these rates.

Scenario 2: Ten Employees

A local restaurant group in Annapolis with ten employees might see per-employee costs for group health insurance in the range of $700 to $1,400 per month.

Again, the larger pool of employees can help to mitigate the impact of individual health risks on the overall premium.

Group Health Insurance for Small Business in Virginia

Scenario 1: Two Employees

A small business in Richmond, Virginia with two employees might find group health insurance options costing between $850 and $1,600 per employee per month for a typical plan.

Scenario 2: Ten Employees

A small retail business with ten employees might experience per-employee group health insurance costs in the range of $650 to $1,300 per month. The dynamics of the local insurance market and the demographics of the employee group will play a role in these figures.

Comparing Group Health to Marketplace

In each of these scenarios, it would be beneficial for the small business owner with two employees to investigate the individual health insurance marketplace.

For instance, if the average cost of an individual plan suitable for their employees is $600 per month, the employer could potentially offer an ICHRA contributing $600 per employee per month.

This would give the employees the flexibility to choose their own plans, and the employer would have a predictable healthcare expense.

Furthermore, these ICHRA contributions would generally be tax-free to the employees and tax-deductible for the employer.

For the larger group of ten, while the per-employee cost of the group plan might be lower than the two-employee scenario, the administrative burden and the need to select a single plan that meets the diverse needs of all employees should still be weighed against the potential benefits of an ICHRA.

How to Choose the Best Group Health Insurance

Deciding between a small group health insurance plan and facilitating individual coverage through an HRA or ICHRA requires careful consideration. Here are some key factors to evaluate:

- Cost: Obtain quotes for small group plans and research the potential costs of individual plans in your area. Factor in any potential tax advantages associated with HRAs or ICHRAs.

- Employee Needs: Understand the healthcare needs and preferences of your employees. Do they prefer the structure of a group plan, or would they value the flexibility of choosing their own individual coverage?

- Administrative Burden: Consider the administrative effort involved in managing a group health plan versus administering an HRA or ICHRA.

- Tax Advantages: Explore the tax benefits for both your business and your employees associated with each option.

- Employee Satisfaction: Think about how each option might impact employee morale and retention. Offering comprehensive benefits, whether through a group plan or an HRA/ICHRA, can be a significant draw for talent.

Final Word: Small Business Group Health Insurance

In conclusion, while securing group health insurance for a small business with just two employees is generally feasible, it’s crucial to understand that the “group discount” may not be substantial at this size.

Therefore, diligently comparing the costs and benefits of small group plans against the individual marketplace, potentially enhanced by the tax advantages of an HRA or ICHRA, is a prudent step.

By carefully evaluating your options and considering the unique needs of your business and employees, you can make an informed decision that supports both their well-being and your company’s financial health.

Free Consultation

Get help from a licensed expert with no obligation.

As an independent agency, we help individuals, families & small businesses get affordable health benefits in:

FL, GA, MD, NC, NJ, PA, SC, TN, TX, VA

Your privacy is our priority. We don’t share personal information or collect any payments, ensuring a safe and secure experience.

That’s BenZen.

Information is meant to be accurate and educational and not intended to be legal, medical or financial advice. Do your own research and contact a professional for help. We earn revenue from partners & advertisers. Read our disclosure for more.

Owner, BenZen Insurance. Licensed insurance broker making it easy for individuals, families and business owners to get affordable health benefits.

His background in marketing, research, insurance, and financial services gives him a unique perspective to help others plan for a secure future and improve their physical, mental, and overall well-being.