When you work for yourself, any health issue can hurt cash flow and your teeth are no exception. Read this guide to find the best dental insurance for self-employed and protect your bottom line!

Oral health is easily overlooked when you’re running a business. Ignoring a toothache or putting off routine dental exams can lead to bigger, more expensive problems down the road.

If you’re self-employed and enrolled in an individual health plan you may have discovered that Marketplace (on-exchange) dental insurance has limitations.

These plans can be affordable, but almost all have waiting periods and low benefit amounts. And if you need to see a dentist for anything more than a checkup, you’ll have to wait 6-12 months depending on the type of procedure.

The good news is that you can buy dental insurance when you’re self-employed outside of the Marketplace any time of year from top-rated insurance carriers like Ameritas, Cigna, and UnitedHealthcare.

And what’s important to know is many of these off-exchange dental insurance plans have no waiting period — meaning you’ll be able to use the plan for basic or major services on day one.

As a self-employed business owner and broker, I help people with health benefits every day. In my opinion, these are the best dental insurance plans for self-employed professionals.

We made it easy for you. Find plans and prices in your area and enroll online.

Why Self-Employed Dental Insurance is Important

Putting together a health benefits package when you’re self-employed can be a challenge.

You can purchase individual health insurance from Healthcare.gov or your state marketplace if you’re not covered by a spouse or household member.

And don’t forget about dental, vision or supplemental insurance.

When shopping for the best self-employed dental insurance look for coverage outside the Marketplace or “off-exchange” plans.

For the most part, off exchange plans are more flexible and many have no waiting periods. This is important if you need dental work now instead of having to wait 6-12 months.

Similar to health insurance, most dental plans have deductibles, copays, and coinsurance, which can vary based on the selected plan. However, there are distinctions.

For instance, some plans have waiting periods and annual maximums that restrict the amount of coverage you can receive within a year.

Cigna dental plans have waiting periods. Ameritas does not. But, Cigna covers orthodontia and Ameritas is child only.

You should compare costs and benefits to decide which makes more sense for your situation.

Additionally, these two insurance plans offer optional vision coverage. Bundle and save!

If you need to see a dentist ASAP, then you may want to consider a plan you can use without having to wait.

Either way, if you’ve priced out the cost of common dental procedures you’ll most likely discover an affordable dental plan is well worth the investment.

Search your ZIP for Ameritas plans and dentists near you

How Does Dental Insurance for Self-Employed Work?

As a self-employed professional, you may not have access to employer plans or group discounts unless it’s from a spouse or a professional association.

However, you do have the option of purchasing individual dental insurance on your own.

Your employment status does not directly affect your eligibility as long as you pay the monthly premium.

Plans pay a percentage of your dental costs, anywhere from 50%-80% leaving you with the difference. Most plans cover routine exams and cleanings 100%.

For example, if a single tooth implant costs $3,000 the right dental insurance plan will usually pay half after a small deductible.

All plans are different. Some will even cover teeth whitening and orthodontics (braces, aligners).

Using a dentist within the plan’s network will maximize your benefits and save money on more expensive procedures like a bridge, dentures, or crowns.

The Cost of Dental Insurance for Self Employed

The average cost of dental insurance for self employed individuals can vary widely depending on several factors, such as the type of plan, the level of coverage, and your location.

Age: As with most types of insurance, your age can also impact the cost of dental insurance. Generally, younger people will pay less for coverage than older people, as they are less likely to need expensive dental procedures.

Overall Health: Your overall health can also impact the cost of your dental insurance. If you have a history of dental problems or are more likely to need expensive procedures, you may pay more for coverage.

Type of Plan: There are many different types of dental insurance plans, and the type of plan you choose can also impact the cost. For example, a plan with a higher annual maximum benefit will typically be more expensive than a plan with a lower benefit.

How Much Is a Dentist Visit Without Insurance?

One of the main reasons why dental insurance is essential for self-employed professionals is the cost of dental care without a plan.

Without coverage, the cost of dental procedures can quickly add up putting financial pressure on your bottom line.

Dental procedures can be expensive, and the cost will vary depending on the treatment, where you live, the dentist you choose, and other factors.

For example, a dental cleaning might cost around $100-$200 without insurance, while a root canal might be somewhere in the $1,000-$2,500.

In addition to the cost of dental procedures, you may have to pay for other out-of-pocket expenses, like deductibles, copays, and coinsurance.

Dental health costs can also sneak up on you, especially if you have a dental emergency or require multiple procedures.

Remember, minor pain can quickly become a major problem if not addressed.

Benefits of Dental Insurance for Self-Employed

Dental insurance for self employed, independent contractors, or freelancers is a smart investment to protect against unexpected bills and valuable time away from your business.

Plus, the cost of dental insurance will usually qualify as a deductible health expense, providing added financial benefits. Consult with your tax advisor.

By investing in dental insurance, you can save money and protect your health in the long run.

Preventative Care: Dental insurance plans usually cover preventative care services such as routine cleanings and check-ups at little or no cost. These services help prevent more costly dental issues in the future, saving you money in the long run.

Cost Savings: Dental insurance plans negotiate discounted rates with dentists and dental specialists. By enrolling in a plan, you can take advantage of these reduced rates and save money on dental services.

Tax Deductions: Self-employed individuals may be eligible for tax deductions on their dental insurance premiums. This can help reduce your taxable income, which can ultimately save you money.

Access to Comprehensive Care: Dental insurance plans provide coverage for a wide range of services, from routine check-ups to more complex procedures like root canals and crowns. By enrolling in a plan, you can access comprehensive dental care that may otherwise be too expensive to pay for out of pocket.

Improved Health Outcomes: Regular dental care is essential for maintaining good oral health, which can impact your overall health and well-being.

By enrolling in a dental insurance plan, you receive preventative care and early treatment for dental issues, leading to improved health outcomes and potentially reducing medical costs in the long run.

The Best Dental Insurance for Self-Employed Online

If you’re self-employed and looking for individual dental insurance, there are a few things to consider.

First, know that you can purchase private dental insurance online directly from the insurance company, outside of the ACA Marketplace. In other words, you’re not restricted to the annual enrollment period.

Additionally, when shopping for coverage don’t focus solely on price.

Compare waiting periods, annual benefit maximums, and covered procedures.

Make sure the plan you choose offers the help you need when you need it.

If you know you need work done and your plan has a waiting period, you’ll need to prepare 6-12 months in advance to come out ahead.

Our dental plans don’t require income verification, occupation or health questions and you can start an instant quote and sign-up on your own 24 hours a day, 7 days a week.

If you need assistance we’re happy to help.

Small Business Benefits?

If you have 2-49 employees, you may be eligible for group rates. Visit our Employer page to learn more.

FAQ

Thanks to the Affordable Care Act health insurance for your child under 18 includes dental coverage.

For adults, dental coverage is mandatory yet as an essential benefit, but you can purchase a dental plan separately during your enrollment.

Dental insurance is available for purchase outside the marketplace any time of year.

The good news is there is talk of dental insurance becoming an essential benefit by 2027!

Waiting periods prevent people from signing up for insurance when they need work done and then dropping the coverage.

Dental insurance waiting periods can vary depending on the company and the procedure. Typically, preventative care has no waiting period, basic services are 6 months and major service are 12 months.

There are dental insurance plans available that have no waiting periods.

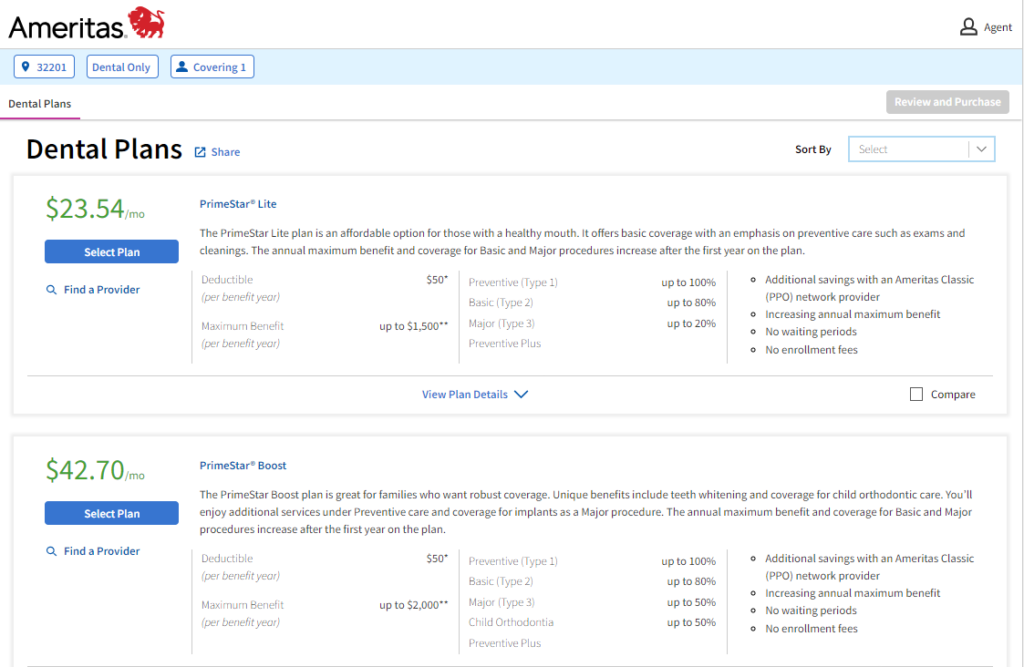

Ameritas Dental

Ameritas PrimeStar® dental insurance plans feature next-day coverage and no enrollment fees.

There are no waiting periods on most dental plans and no enrollment fees when you sign-up online.

Preventive visits, such as dental exams and cleanings, are covered up to 100%.

Fillings and extractions are covered in Basic services. Crowns, implants, dentures and teeth whitening are covered in Major services with PrimeStar Access.

Select plans include additional benefits such as vision, LASIK, orthodontia, or hearing care. Check your ZIP Code for availability.

- PrimeStar Lite

- PrimeStar Boost

- PrimeStar Complete

- Annual maximums from $1,500-$3,000

- Increasing Benefits

- Child Orthodontia

Not all plans are available in all states. Check your ZIP Code for availability. Rates provided by Ameritas.

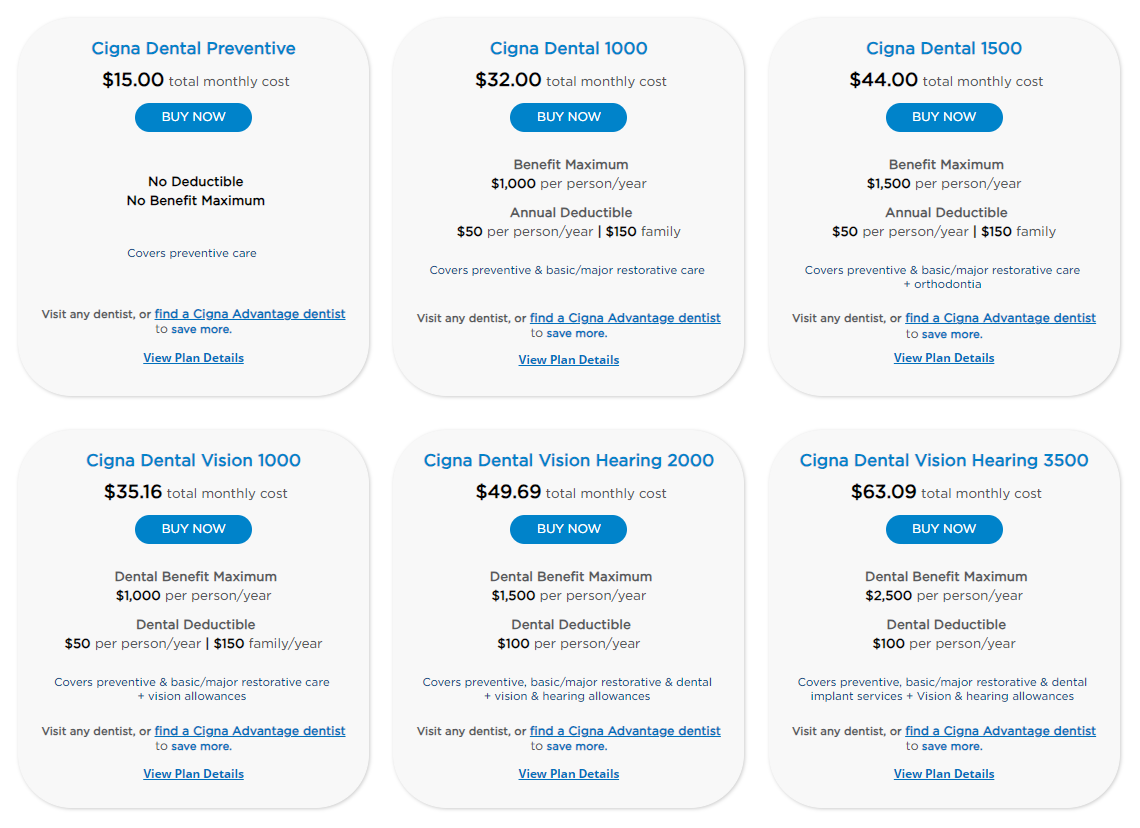

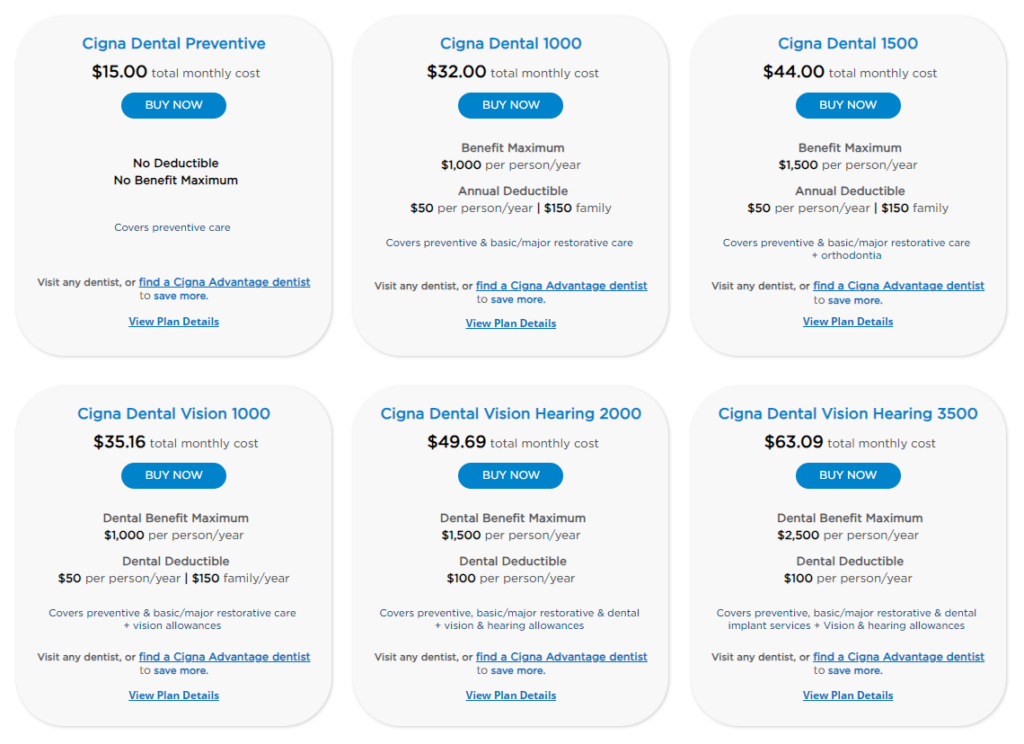

Cigna Dental

Affordable dental protection that covers more than just teeth! Cigna offers individual dental insurance plans along with options for vision and hearing.

Get instant quotes on Cigna Dental plans, dental & vision, high annual maximum plans or dental, vision & hearing bundles.

Not all plans are available in all states. Check your ZIP Code

- Cigna Dental 1000

- Cigna Dental 1500 (covers orthodontia!)

- Cigna Dental Vision 1000

- Cigna Dental Vision Hearing 2000

- Individual plans start as low as $20 a month

Not all plans are available in all states. Check your ZIP Code for availability. Rates provided by Cigna.

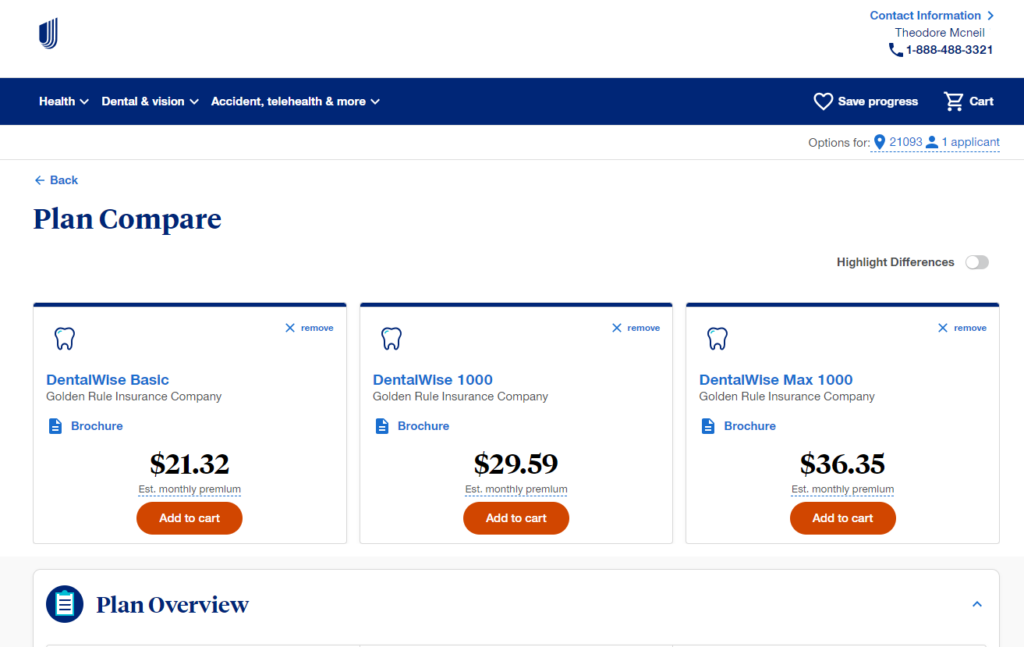

UnitedHealthcare

From one of the best known names in healthcare, affordable solutions to protect your important assets. Their large network is widely accepted throughout the country.

UnitedHealthcare dental plans provide flexible options for basic and major dental services with no age limit, no waiting period, Day 1 coverage and increasing benefits.

Preventive, basic and major services covered. Annual maximums from $1,000-$3,000.

Popular plans: DentalWise 1000, DentalWise Max 1000 (covers vision) and DentalWise 2000 (covers implants)

DentalWise Max plans include vision. DentalWise 2000 covers implants with a separate $1,500 benefit (12-month waiting period applies to implants. No waiting period on all other services)

Online quoting and enrollment are available in licensed states. Contact us for assistance or if your state is not listed:

DC, FL, GA, MD, MS, NC, PA, TN, TX, VA.

- DentalWise 1000

- DentalWise Max 1000 (& vision)

- DentalWise 2000 (covers implants with additional $1,500 benefit)

- DentalWise Max 2000 (& vision)

- DentalWise Max 3000

Not all plans are available in all states. Check your ZIP Code for availability. Rates provided by UnitedHealthcare.

Information is meant to be accurate and educational and not intended to be legal, medical or financial advice. Be sure to do your own research and contact a professional for help. Our site is free to use, but we may receive a commission from our partners & advertisers at no additional cost to you. Read our disclosure for more information.

Licensed health & life insurance broker helping individuals, families and small business owners get better access to affordable health benefits.

His background in marketing research, insurance and retirement plans gives him a unique perspective to help others plan for the future and improve their physical, mental and financial well-being.