We may receive a commission from advertisers at no additional cost to you. Read our disclosure for details.

Deciding if zero deductible health insurance is good or bad depends on your financial situation, your health and even where you live.

While it may seem like a good idea, lower deductibles usually come with higher monthly premiums whether you use the plan or not.

Knowing how health deductibles work is important when making decisions regarding your health insurance especially if you’re self-employed, freelancer or independent contractor.

To understand deductibles, metal levels and to check for potential savings like tax credits, we put together this guide to help explain the different aspects of individual ACA Health Insurance.

Bookmark this page, contact us if you have questions and be prepared for Open Enrollment in November.

How does $0 deductible health insurance work?

A health insurance deductible is the amount of money that you must pay out-of pocket before your health insurance company will start covering your medical costs.

Deductible amounts vary widely and can range from $0 to over $5,000 per person.

In general, a low deductible plan means higher monthly payments and a high deductible plan has lower premiums.

Purchasing $0 deductible health insurance can be beneficial if you are looking to limit your out-of-pocket expenses when you need to use the coverage, but you’ll have to budget for the higher monthly premiums.

The IRS sets the limits for High Deductible Health Plans and it usually goes up a little each year.

In 2023, you have an HDHP if your individual deductible is more than $1,500 or your family plan is more than $3,000. This is important because if you have an HDHP by this definition you are eligible to open an HSA.

Update: 2024 IRS High Deductible Health Plan Limits Announced

A downside to HDHP’s is sometimes the policyholder will skip doctor visits & treatments altogether to avoid the lump sum expense.

For many Americans, having to come up with $3,000-$5,000 on short notice can present a challenge.

Pros of $0 deductible health insurance

The biggest advantage of $0 deductible health insurance is that you won’t have to pay that large out-of-pocket expense upfront before your insurance coverage kicks in.

A $0 deductible health plan can be a way to save money on healthcare costs especially if you have a chronic condition or know you’ll require frequent medical care.

By planning ahead and setting aside funds for healthcare, you can ensure that you’re able to keep your policy active and get the care you need when you need it.

Cons of $0 deductible health insurance

While $0 deductible health insurance may seem like a great option, there are some potential downsides to consider.

First, these plans often have higher overall costs, including higher monthly premiums and coinsurance.

Many individuals lose coverage because they can’t keep up with the payments. If a policy lapses, it can be difficult to renew or even get a plan from a new carrier based on your claim history.

Additionally, some $0 deductible plans may have limited provider networks, meaning you may not have access to the doctors and specialists you need. Compare plans carefully.

Finally, with a low or $0 deductible plan you won’t be able to take advantage of a Health Savings Account which are set aside specifically for HDHPs.

When is Open Enrollment?

Open Enrollment, which starts in November each year for individual ACA Marketplace Health Plans is your opportunity to enroll for coverage. Employer plans may have different schedules.

Outside of that time period, you may be eligible for a Special Enrollment Period if you experience certain life events, such as loss of coverage, getting married, adopting a child, or a change in household size.

Healthare.gov is the federal marketplace for health plans, but some states actually manage their own exchange.

For example, Maryland residents have to go through Maryland Health Connection for ACA health insurance.

You can also use platforms like HealthSherpa or Stride. Many consumers find these sites to be easier to use with no additional costs.

What are the metal levels?

There are four different metal levels of coverage. These metals, determined by the Health Insurance Marketplace, signify the different payouts associated with each plan.

Bronze level plans payout 60/40 (60% paid by insurance, 40% paid by consumer). Silver plans payout 70/30.

Gold plans payout 80/20 and Platinum plans have a 90/10 payout. Typically, higher payouts from the insurance company mean higher monthly premiums. Lower deductible plans are usually in these metal levels.

Example: Gold Plan with a $5,000 deductible

Let’s say you break a leg. Ambulance, ER, surgery, overnight hospital stay & crutches total $15,000.

Your first obligation is the $5,000 deductible which leaves you with a hospital bill of $10,000.

With your Gold Plan you share the bill with the insurance company 80/20 which is $2,000.

Your total out-of-pocket cost for this accident: $5,000 + $2,000 = $7,000.

Example: $0 deductible vs. $3,000 deductible

At first glance, the Silver plan below isn’t all that bad with a $238 a month premium after tax credits.

The plan will pay 70% of covered events with a $0 deductible. You’ll be responsible for the remaining 30% up to the out-of-pocket max. After that, the insurance company will cover your visits for the rest of the year.

On the other hand, the Gold plan has the same $238 a month premium, a $500 deductible but a lower out-of-pocket max of $8,150. Plus, specialist visits and generic drug costs are lower.

You can see in the examples below how higher deductibles compare with lower monthly premiums and lower costs for prescriptions.

Ultimately, whatever you choose will depend on your personal situation – health, family and finances. Our advice is to take the necessary steps to avoid financial hardship down the road.

Silver plans qualify for cost sharing reductions

Tax credits are one way to make health insurance more affordable. Cost sharing reductions (CSRs) take it a step further by helping to reduce or limit the related expenses of health insurance like deductibles. They are based on income and are only available with Silver.

If you’re young, healthy and rarely see a doctor the lower monthly premiums of a Bronze plan (with higher deductibles) can save you a lot of money upfront.

On the other hand, if you have children higher deductibles might not be ideal since you are likely to visit the pediatrician a lot. ( I can relate to this one!)

Also, higher deductible plans may not be the best idea if you have a pre-existing or chronic condition unless you are financially prepared.

How to compare health insurance plans

Shopping and comparing health insurance plans from an ACA Marketplace can seem intimidating, but there are other platforms you can use.

HealthSherpa is free and easy-to-use where you can explore your options and enroll in the best plan.

Note: More and more states are launching their own health exchange. If that’s the case, the platform will alert and redirect you.

Also, if you already have coverage you can use HealthSherpa to renew or open a special period if you have a qualifying event.

How can I save money on deductibles?

There are several ways to manage your healthcare expenses. What’s most important is being financially prepared when and if something happens.

High deductibles and unexpected bills are some of the main reasons for medical debt.

If your employer offers a voluntary benefit like Aflac, consider a supplemental plan that will pay a cash benefit to help recover your out-of-pocket costs.

Or, you could look into a Health Savings Account (HSA) which allows you to set aside pre-tax money to cover medical costs when you need it.

Supplemental Insurance

Aflac is known for its workplace employee benefits and supplemental insurance that adds a level of protection against health care costs that may go beyond the scope of your existing plan.

Essentially, it covers the gaps that health insurance leaves behind like deductibles, copays, and other related expenses.

If you’re injured or become ill, the right Aflac plan can provide you with a lump-sum payment to help pay for your related expenses and you have the flexibility and financial freedom to use the money however you choose.

Ask your employer about how to sign up for Aflac.

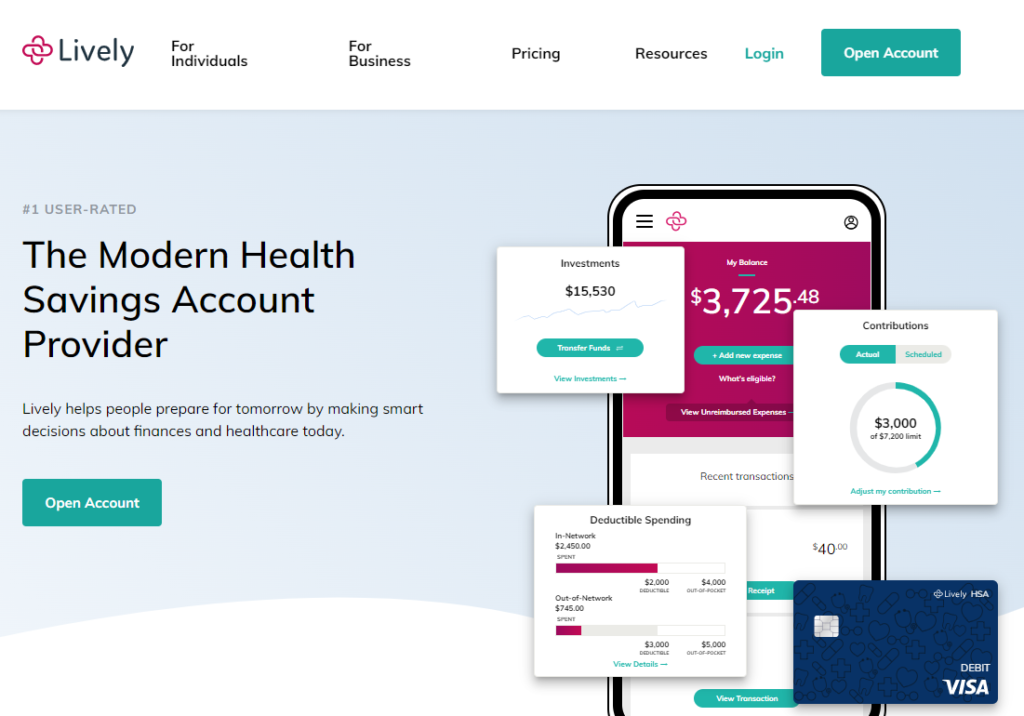

Open a Health Savings Account

A health savings account (HSA) makes sense if you have an HDHP. You open an account, contribute pre-tax dollars, get tax-free growth and tax-free withdrawals for qualified medical expenses only.

The 2023 HSA contribution limits are $3,850 for individual coverage and $7,750 for family.

Meaning, an individual could put away up to $320 a month.

If you have the discretionary income an HSA can be very useful to help manage high deductibles and medical expenses. It’s also a smart investment tool for retirement.

Conversely, if you don’t have the extra money to set aside each month or take advantage of the investing features of an HSA you might as well stick with a traditional savings account.

That way, if a non-medical emergency comes up you’ll have access to your funds without penalty.

Don’t use your credit cards!

The whole point of financial security is having resources in place and avoiding debt. If you’re faced with large medical expenses and not much cash you might be tempted to charge it.

You’ve probably heard the Fed is raising rates like crazy to curb inflation which will have a huge impact on how much you owe the credit card company each month.

Even if you have to borrow from a friend or work something out with the hospital do what you can to avoid using plastic.

Final: $0 deductible health insurance good or bad?

Whether a $0 deductible health insurance plan is good or bad mainly depends on your health and financial circumstances.

Since a $0 deductible health insurance plan means higher monthly premiums it will require more budgeting to make sure you can keep up your payments.

As you compare health plans, striking a balance might be the optimal approach.

Opting for plans with slightly lower premiums alongside a manageable deductible could provide a middle ground that accommodates both your healthcare needs and financial stability.