Deciding if zero ($0) deductible health insurance is good or bad depends on your financial situation, your health, and even where you live.

While it may seem like a good idea, lower deductibles can come with a higher tradeoff (premium, copay, coinsurance) so it’s important to know how to compare plans.

Knowing how health insurance deductibles work is a crucial first step during plan selection.

Our team specializes in marketplace health plans in ten states along with employee benefits for small business.

You can find low and zero deductible health insurance from all major carriers, but this guide is geared towards consumers shopping for Affordable Care Act (ACA) marketplace coverage.

Free Assistance

As an independent broker our team will help you find the best plan to meet your needs and budget.

We have access to the same plans & prices, but with free dedicated support. That’s BenZen!

Ted McNeil

Owner, Broker

BenZen Insurance

Licensed: FL, GA, MD, NC, NJ, PA, SC, TN, TX, VA

Ready to get started? Browse plans below or schedule your consultation!

How Does No Deductible Health Insurance Work?

Having health insurance with no deductible sounds great right?

First, the deductible is the amount you pay before your health insurance company will start covering your bills. This will vary based on where you live and which plans are being offered.

The deductible can range from $0 to over $5,000 or more. It does not include your monthly payment.

In general, no or zero ($0) deductible health insurance means higher monthly payments.

Conversely, a high-deductible plan typically has lower monthly premiums.

Purchasing $0 deductible health insurance can be a smart move if you want to limit your out-of-pocket expenses when it’s time to use the plan, but may have a higher monthly payment.

Also, it’s important to know the deductible is an annual amount and will reset at the start of the new year.

Zero Deductible Health Insurance: PROS

The biggest advantage of $0 deductible health insurance is that you won’t have to pay that large out-of-pocket expense upfront before your insurance coverage kicks in.

For example, if you have an expensive procedure scheduled next month with a $9,100 deductible, your doctor’s office or hospital may want to collect this prior to surgery!

A $0 deductible health plan can be a way to save money on healthcare costs especially if you have a chronic condition or know you’ll require frequent medical care.

By planning ahead and setting aside funds for healthcare, you can ensure that you’re able to keep your policy active and get the care you need when you need it.

Zero Deductible Health Insurance: CONS

While $0 deductible health insurance may seem like a great option, there are some potential downsides to consider.

First, these plans often come with higher overall costs, including higher monthly premiums and coinsurance.

Zero deductible plans do exist in the Bronze category, but are more common at the Silver & Gold level.

Some consumers lose coverage because they can’t keep up with the higher payments.

Our goal is to help our clients find a good balance to fit their needs and budget.

Ready to get started? Schedule your free consultation!

When can I enroll in Marketplace Health Insurance?

Open Enrollment, which starts in November each year for ACA Marketplace Health Plans is your opportunity to enroll for coverage with little to no restrictions.

Outside of that time period, you may be eligible for a Special Enrollment Period if you experience certain life events, such as loss of coverage, getting married, adopting a child, or a change in household size.

Healthare.gov is the federal marketplace for health plans, but each year more states launch their own state based exchange. (SBE)

What are the metal levels?

There are four different metal levels of coverage. These metals signify the different payouts associated with each plan.

Bronze level plans payout 60/40 (60% paid by insurance, 40% paid by consumer). Silver plans payout 70/30.

Gold plans payout 80/20 and Platinum plans have a 90/10 payout.

Typically, higher payouts from the insurance company mean higher monthly premiums. Lower deductible plans are usually in these metal levels.

Example: Gold Plan with a $5,000 deductible

Let’s say you break a leg. Ambulance, ER, surgery, overnight hospital stay & crutches total $15,000.

Your first obligation is the $5,000 deductible which leaves you with a hospital bill of $10,000.

With a Gold Plan you share the bill with the insurance company 80/20 which is $2,000 on your side.

Example: $0 deductible vs. $500 deductible

At first glance, the Silver plan below isn’t all that bad with a $238 a month premium after tax credits.

The plan will pay 70% of covered events with a $0 deductible. You’ll be responsible for the remaining 30% up to the out-of-pocket max. After that, the insurance company will cover your visits for the rest of the year.

On the other hand, the Gold plan pays 80%, has the same monthly premium, a $500 deductible and a lower out-of-pocket max of $8,150.

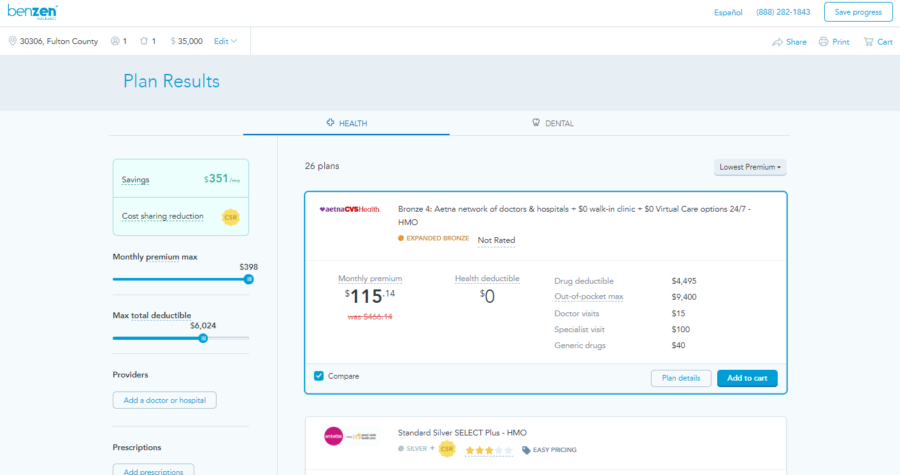

Zero and low-deductible health plans

You can see in the examples below how higher deductibles compare with lower monthly premiums and lower costs for prescriptions.

Ultimately, whatever you choose will depend on your personal situation – health, family and finances.

Silver plans can help lower your costs

Tax credits are one way to make health insurance more affordable.

Cost Sharing Reductions (CSRs) take it a step further by helping to reduce or limit the related expenses of health insurance like deductibles, copays and coinsurance.

CSR’s are only available with Silver plans.

If you’re young, healthy and rarely see a doctor the lower monthly premiums of a Bronze plan (with higher deductibles) can save you a lot of money upfront.

On the other hand, if you have young children higher deductibles might not be the best choice since you’re likely to visit the pediatrician a lot. (I can relate to this one!)

Also, higher deductible plans may not be the best idea if you have a pre-existing or chronic condition.

How to compare health insurance deductibles

There are several ways to manage your healthcare expenses. What’s most important is being financially prepared when and if something happens.

High deductibles and unexpected bills are some of the main reasons for medical debt.

When comparing health insurance deductibles, consider these key questions:

What are the monthly premiums associated with different deductible levels? Lower deductibles, including zero deductible options, typically come with higher monthly premiums.

What is your anticipated healthcare usage? If you foresee frequent doctor visits, require regular prescriptions, or manage chronic conditions, a lower or zero deductible plan might be financially advantageous despite the higher premium.

What is your risk tolerance and financial capacity to handle unexpected medical costs? A higher deductible plan might be suitable if you are generally healthy and comfortable with a larger out-of-pocket expense in case of a significant health event.

Final Word: Is Zero Deductible Health Insurance Good or Bad?

As we’ve explored, the decision of whether zero deductible health insurance or a plan with no deductible is “good” or “bad” isn’t so simple.

Key considerations include the trade-off between higher monthly premiums and lower out-of-pocket costs at the point of service.

Choosing a $0 deductible plan may require careful budgeting to maintain the monthly obligation.

While it offers the benefit of predictable, immediate coverage, the higher monthly expense needs to be factored into your overall financial planning.

Most of our clients choosepting for a plan with moderately lower premiums paired with a manageable deductible can provide a middle ground, offering both more affordable monthly costs and protection against significant unexpected medical bills.

This approach allows you to benefit from insurance coverage without the potentially substantial upfront cost of a high deductible, while also keeping monthly expenses more predictable than a zero deductible option.

Ultimately, the ideal choice depends on your individual circumstances.

If you’re feeling uncertain about which plan aligns best with your needs and budget, don’t hesitate to contact us for a free, personalized consultation.

We’re here to help you navigate these options and make the process easy.

Free Consultation

Our team is dedicated to making it easy for individuals, families & small business owners to find affordable plans & benefits.

Start a quote or schedule a free consultation today!

Privacy is our priority. We don’t share your personal information or collect payments for your peace of mind.

That’s BenZen.

Ted McNeil

Owner, Broker

BenZen Insurance

Free Consultation

Our team is dedicated to making it easy for individuals, families & small business owners to find affordable plans & benefits.

Start a quote or schedule a free consultation today!

Privacy is our priority. We don’t share your personal information or collect payments for your peace of mind.

That’s BenZen.

Ted McNeil

Owner, Broker

BenZen Insurance

Information is meant to be accurate and educational and not intended to be legal, medical or financial advice. Do your own research and contact a professional for help. We earn revenue from partners & advertisers. Read our disclosure for more.

Owner, BenZen Insurance. Licensed insurance broker making it easy for individuals, families and business owners to get affordable health benefits.

His background in marketing, research, insurance, and financial services gives him a unique perspective to help others plan for a secure future and improve their physical, mental, and overall well-being.